The indices ended marginally higher today holding support after a weak opening. They pulled back late in the day, so there is still much in the air right now. The markets have been in need of a breather and are still above the 20sma's, so a top or reversal is still to early to confirm. Here are a few charts to watch in the coming days.

Rambus Inc. (Public, NASDAQ:RMBS)

Semiconductors were strong today and if they are to resume a leadership role then RMBS may break out of this trading range.

Perficient, Inc. (Public, NASDAQ:PRFT)

PRFT is trading a tight little triangle and may be offering a nice place to enter the trend.

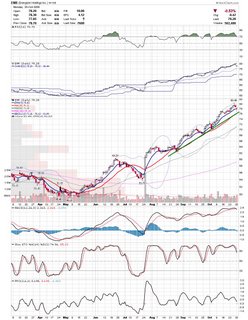

Energizer Holdings, Inc. (Public, NYSE:ENR)

ENR is another strongly trending stock and may be finding support near the 20sma.

Ansoft Corporation (Public, NASDAQ:ANST)

ANST is still within a pennant consolidation and may be offering a decent entry for a long position.

IHS Inc. (Public, NYSE:IHS)

IHS is finding support near the 20sma and has held above the larger ascending triangle base it cleared a few weeks ago.

VAALCO Energy, Inc. (Public, NYSE:EGY)

EGY is in the process of consolidating the recent downtrend breakout and may be getting close to moving higher.

Panera Bread Company (Public, NASDAQ:PNRA)

PNRA tagged the lower band today and may get a technical bounce here. Usually, a stock comes back to tag the band a second time within a few sessions, but a nimble trader can get a decent move off the first bounce.

Foundry Networks, Inc. (Public, NASDAQ:FDRY)

FDRY is also hanging on to the lower band and formed a hammer today. it looks like it will make a run to the 20sma.

Cameco Corporation (USA) (Public, NYSE:CCJ)

CCJ is one of the few shorts that look enticing to me here. It looks like it may come back to test the low 30's.

Good Luck,

DT

Posted by

downtowntrader |

10/30/2006 10:26:00 PM

|

3

comments »

Subscribe to:

Post Comments (Atom)

DT,

Its great that you mentioned PRFT - a very well trending stock. I hopped aboard the PRFT train a few weeks ago with an entry of 14.50.

Although I am first and foremost a swing trader, after watching many great trending stocks that turn into 5 - 6 - and even 10 baggers, I figured that Trend Following is definately a simple and solid methodology. So I have divided up my portfolio between these two strategies.

I have noticed that you post many great trending stocks on your blog, do you use a trend following methodology (referring specifically to following the larger trend), or do you focus on swing trading the pullbacks?

Regards,

Muaad

Thanks for your watchlist.

How you are able to use 5 indicators in the chart provided by stockchart. Maximum I am able to use only 3 indicators from the free chart version. Are you using premium version?

Thanks!

Muaad,

I've looked at different trend following strategies and in the right market conditions may put on a few longer term trades, but I try to focus on the swing trades. For instance, if we do enter a bear market soon, then I would look to enter a few longer term trend following trades, but, I find that I lack the patience and confidence in my trend following strategies. Also, I am trying to perfect my methodology before trying to do too much.

Anon,

I do use the premium version of stockcharts, but three indicators is plenty. I would use MACD, Slow Stochastics and bollinger bands if I was limited to three.

DT