Dow broke 11 thousand today and everything seems peachy. This usually means it's time to take a little off the table. We had a little warning today as I think the smart money is anxious to take a little off the table. But there is also the chance there is a lot of anxious money on the sidelines that was waiting for the break of resistance. Either way, caution is prudent. The first few charts highlighted tonight are stocks that I am targeting if and when the market pulls back. I will not buy right now as they are all extended from decent entry points.

KOMG: Broke a cup and handle and is near pivot point, but I think it's best to wait on this one as market is extended and this move looks like it needs a little consolidation. JOYG: I sold all my shares already and will wait for the pullback. Volume looks good but there are index funds that are required to add JOYG after they were added to NAS100.

JOYG: I sold all my shares already and will wait for the pullback. Volume looks good but there are index funds that are required to add JOYG after they were added to NAS100.

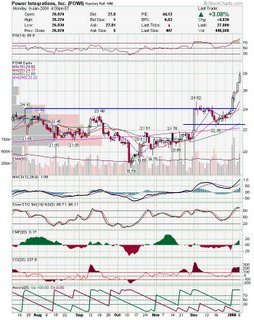

I've been targeting NWRE and will buy on the next pullback. POWI: This looks like a heck of a move and should pullback or at least consolidate into a flag.

POWI: This looks like a heck of a move and should pullback or at least consolidate into a flag. TTI: may of started slowing down. Look at volume on breakout.

TTI: may of started slowing down. Look at volume on breakout. TRAD: Added to IBD 100 after closing over 15. Strong volume with this move.

TRAD: Added to IBD 100 after closing over 15. Strong volume with this move. The following are stocks I own but may still be playable.

The following are stocks I own but may still be playable.

SUF: I would normally not recommend any stock that had moved 25%, but I think SUF is under heavy accumulation. I am holding at this point and for the foreseeable future. MTXX: I hate to buy this late in the game, but MTXX looks like a decent play here. I took a small initial position and will watch to see if I should add more.

MTXX: I hate to buy this late in the game, but MTXX looks like a decent play here. I took a small initial position and will watch to see if I should add more. MNST: I like this as an intermediate term trade. Chart looks good and I think there are a couple things favoring a move up here. Monster.com is in a hot sector and has a strong IBD rating (see below). Also, I think tech spending may be up this year, and the tech job market may be strengthening. Tech jobs are high paying, and therefore MNST would get higher commisions for these types of jobs. Chartwise, the MACD just crossed and volume is increasing on the breakout. Near term swing target is near 46, but this may become a core hold for me.

MNST: I like this as an intermediate term trade. Chart looks good and I think there are a couple things favoring a move up here. Monster.com is in a hot sector and has a strong IBD rating (see below). Also, I think tech spending may be up this year, and the tech job market may be strengthening. Tech jobs are high paying, and therefore MNST would get higher commisions for these types of jobs. Chartwise, the MACD just crossed and volume is increasing on the breakout. Near term swing target is near 46, but this may become a core hold for me.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

People ar ehaving trouble reading your charts - http://tradermike.net/2006/01/waiting_for_a_better_entry#comments