I posted a chart on MCX a couple nights ago, and they did prove support near the 61.8% retrace again. This stock has a lot of potential for a few reasons. There is a chance that MCX will debut on the IBD 100 if it closes over 15 on any given Friday. It has an EPS of 96 and RS of 95 on investors.com. Here is the post that alerted me to the IBD 100 rumor. (Thanks to bulltrader)

http://www.thebulltrader.com/2005/12/18/mcx-ibd100-rumors/

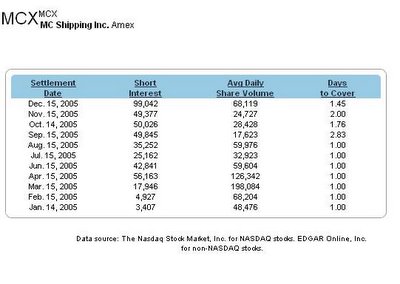

Also, I believe there is a fairly large short position in MCX due to the previous large runup and subsequent pullback. This is the open interest as of December 15, but the numbers may be higher at thispoint. I know I can't find any shares to short right now. With the combination of high short interest and extremely thin trade for this issue, shorts could be in a world of trouble here. Here is the daily chart showing the previous run up and the 61.8% correction. It actually went a little deeper, but with low volume stocks I like to give a little leeway. All other indicators are healthy at this point and ready to turn up in my opinion.

Here is the daily chart showing the previous run up and the 61.8% correction. It actually went a little deeper, but with low volume stocks I like to give a little leeway. All other indicators are healthy at this point and ready to turn up in my opinion.

Here is the weekly chart. Volume is building back up a little and MCX is respecting support.

It seems to me that all lot of things are lining up giving decent odds on playing MCX to the long side. Yesterday could just be the beginning of a push to 15. After that, who knows if IBD crowd will follow suit.... Just look at IFO as an example of IBD100 debut.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

Check out F (ford) stock, it is retracing to 38.2% and can prove to be a good buy once it touched the line, also the MA(10),EMA(20),EMA(30) is crossing over, I believe it would be a good opportunity to enter swing trade probably tomorrow EOD.