I'm starting to see a few more interesting set ups but there are still a lot of stocks that are too extended for a safe entry. There are two types of plays I will be targeting in this market environment. The first setup which is reliable in bull markets and rallies is the pullback to support. I look for stocks that have broken from a base and are making the first pullback to test support. I typically buy my first lot as close as possible to support, and then the next lot after I see a bullish candle confirmed at support. When I say "confirmed", what I'm looking for is a higher high after a hammer for example. The second play is a pre earnings run. We are starting the earnings season and I try to find stocks that are expected to have good earnings. These stocks tend to rise up to earnings day. I exit the position before earnings about 99% of the time.

TALX: This stock was one of the first to move on this rally and has pulled back a little. This may be ready to resume uptrend. TALX will split soon and stocks tend to run towards the split date. CMED: Very orderly pullback to the 10 day SMA. This sector is hot and CMED has some IBD buzz right now, so I expect a breakout to a new all time high soon.

CMED: Very orderly pullback to the 10 day SMA. This sector is hot and CMED has some IBD buzz right now, so I expect a breakout to a new all time high soon. VAR: This may be a good earnings play. They report earnings on 1/25 and the chart is looking good. They broke out of a pullback channel, and are trying to break out of the current base. MACD is crossing over.

VAR: This may be a good earnings play. They report earnings on 1/25 and the chart is looking good. They broke out of a pullback channel, and are trying to break out of the current base. MACD is crossing over. BLK:Another earnings play. They report earnings on 1/19 so this would be a quick play. I would wait for them to make a higher high at this point.

BLK:Another earnings play. They report earnings on 1/19 so this would be a quick play. I would wait for them to make a higher high at this point. SAY: They pulled back and seem to be holding the trendline.

SAY: They pulled back and seem to be holding the trendline. GROW:Nice bullish candle on test of dotted blue line. Read my previous post on GROW.

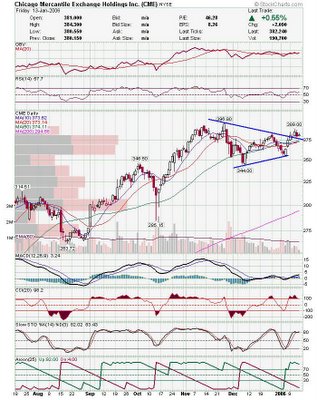

GROW:Nice bullish candle on test of dotted blue line. Read my previous post on GROW. CME: This might be a decent mid term trade as metal ore rallies in GOLD, SILVER, and COPPER may of brought in more money in. Triangle was broken and is now testing the trendline as support.

CME: This might be a decent mid term trade as metal ore rallies in GOLD, SILVER, and COPPER may of brought in more money in. Triangle was broken and is now testing the trendline as support.

If any of these trigger tomorrow I will try and post a more thorough analysis of it intraday.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment