Interesting enough, I'm not finding that many solid shorts. I expected to find a lot in Oil sector but a lot of them look like they will be good shorts by the middle to end of week. I have a lot of charts tonight so let's get to it.

NBIX looks real nice if you dig deeper and look at the 15 minute chart over the last few days. ADAM had a breakout with great volume. I would expect a follow through.

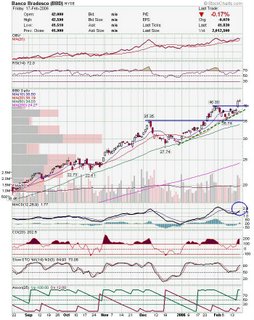

ADAM had a breakout with great volume. I would expect a follow through. BBD has a very nice looking daily chart. Could come back and test the line where it would be a solid buy.

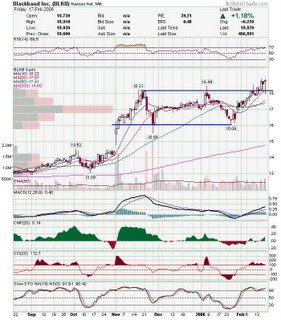

BBD has a very nice looking daily chart. Could come back and test the line where it would be a solid buy. Need to clear recent highs before I would take BLKB.

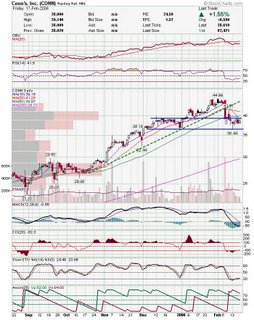

Need to clear recent highs before I would take BLKB. CONN looks more like a short to me at this point, but I would be watching the support nearby.

CONN looks more like a short to me at this point, but I would be watching the support nearby.

ENDP is another one that looks like a short to me although it has had a decent move to reclaim the 50 SMA. Watch for a failure to hold the horizontal trendline. GEOI is in the wrong sector right now, but chart looks pretty good. If GEOI ever makes it over $15 it will probably make the IBD100. As a side note, IBD has purged a bunch of oil service stocks from the IBD 100. Something to think about.

GEOI is in the wrong sector right now, but chart looks pretty good. If GEOI ever makes it over $15 it will probably make the IBD100. As a side note, IBD has purged a bunch of oil service stocks from the IBD 100. Something to think about. I've seen a few sites calling for an IBM short, but it look more like a wait and see to me. It can roll over for sure, but RSI downtrend is broken and there is a MACD divergence on the recent low. Also, 200SMA has actually turned up. If 200 falls, then it should test lower wedge trendline. But if upper wedge is broken, then we may have a bottom put in.

I've seen a few sites calling for an IBM short, but it look more like a wait and see to me. It can roll over for sure, but RSI downtrend is broken and there is a MACD divergence on the recent low. Also, 200SMA has actually turned up. If 200 falls, then it should test lower wedge trendline. But if upper wedge is broken, then we may have a bottom put in. IHS look interesting. Sitting at bottom of channel with plenty of upside here.

IHS look interesting. Sitting at bottom of channel with plenty of upside here. INFA made the IBD 100 and also had a positive article on Barrons. Chart looks good and could be on it's way to 20's.

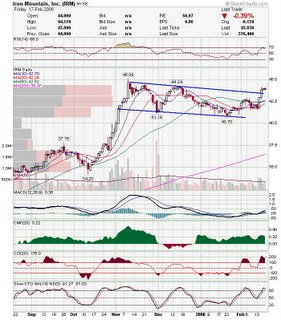

INFA made the IBD 100 and also had a positive article on Barrons. Chart looks good and could be on it's way to 20's. IRM may hold steady for a few days, but keep an eye on it.

IRM may hold steady for a few days, but keep an eye on it. KLIC may come back to rising trendline, but watch it for a break of the upper trendline.

KLIC may come back to rising trendline, but watch it for a break of the upper trendline. Nice triangle forming on MIDD. I would wait for a clear break on volume though.

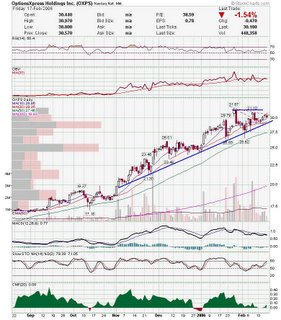

Nice triangle forming on MIDD. I would wait for a clear break on volume though. OXPS is also looking interesting lately.

OXPS is also looking interesting lately. PTRY never recovered from the open Friday, but looks like it may hold double trendline support here.

PTRY never recovered from the open Friday, but looks like it may hold double trendline support here. PWAV had a nice move Friday and may follow through.

PWAV had a nice move Friday and may follow through. STX looks good here.

STX looks good here. Thanks to traderjamie over at Wall St. Warrior for TRID. Nice breakout here.

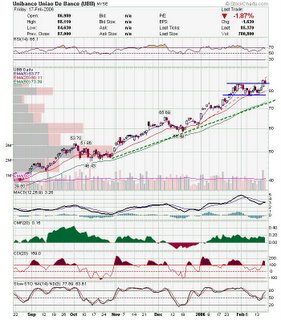

Thanks to traderjamie over at Wall St. Warrior for TRID. Nice breakout here. Another Latin Bank here. UBB has an upper trendline to deal with, but overall looks healthy.

Another Latin Bank here. UBB has an upper trendline to deal with, but overall looks healthy. VAR has been consolidating in a very tight range and could break out any day.

VAR has been consolidating in a very tight range and could break out any day. Also, I try not to repeat the same stocks too often, so try to read back once in a while as some of the ones I post move a few days later. ARBA, DIET, and HANS are recent examples that still look decent.

Also, I try not to repeat the same stocks too often, so try to read back once in a while as some of the ones I post move a few days later. ARBA, DIET, and HANS are recent examples that still look decent.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

Nice work DT!

I'm adding IHS, INFA, and GEOI to my watchlist.