The markets are at a crossroads right now. I am seeing conflicting signals in the indices so I am tightening my stops and I will keep my trades shorter in time frame. I still don't feel it's time to go predominantly short, but I am seeing some more short setups. Here are some interesting charts from this weekends scans.

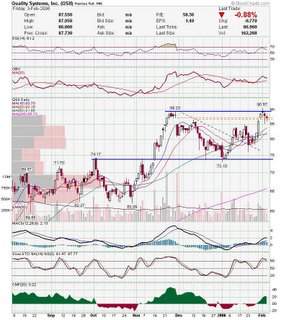

Keep an eye onQSSI for a breakout. There is a chance it pulls back and forms a triangle. ABAX is showing an aversion to dropping below the breakout point. It's a buy if it makes a higher high in my opinion.

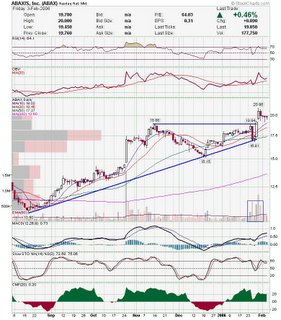

ABAX is showing an aversion to dropping below the breakout point. It's a buy if it makes a higher high in my opinion. PETS is pulling out of a quick bull pennant and may be good for a 2-3 day swing.

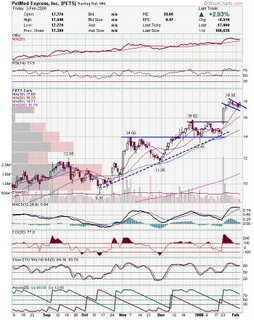

PETS is pulling out of a quick bull pennant and may be good for a 2-3 day swing. Nice bull pennant on SWSI. Wait for the break of the trendline.

Nice bull pennant on SWSI. Wait for the break of the trendline. ANTP is forming a very loose pennant type consolidation base, and could have a breakout. With the base this sloppy, I would be quick to lock in profits.

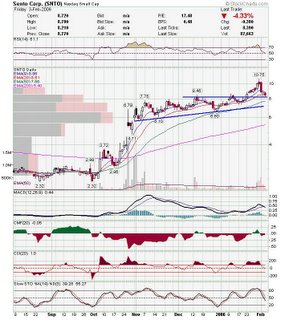

ANTP is forming a very loose pennant type consolidation base, and could have a breakout. With the base this sloppy, I would be quick to lock in profits. SNTO broke out of a nice triangle and is pulling back to test breakout area. Keep an eye for a bounce.

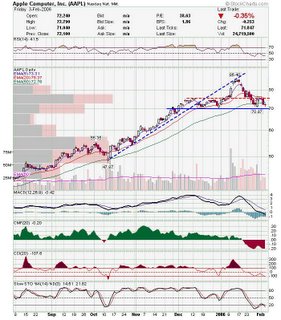

SNTO broke out of a nice triangle and is pulling back to test breakout area. Keep an eye for a bounce. Is AAPL still a market leader. We will soon find out. It is looking pretty weak and is setting up for another test of support. Keep an eye on it for a bounce or breakdown.

Is AAPL still a market leader. We will soon find out. It is looking pretty weak and is setting up for another test of support. Keep an eye on it for a bounce or breakdown. DIETS is consolidating substantial gains, and formed a nice hammer. May be ready for a little bounce.

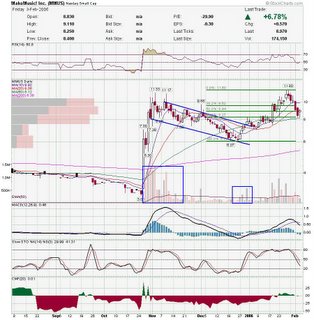

DIETS is consolidating substantial gains, and formed a nice hammer. May be ready for a little bounce. MMUS is a chart I highlighted a few days ago as a possible cup and handle base forming. I think this is the bottom of the handle (61.8% retrace) and that it will resume the uptrend here. Watch for a breakdownnear previous pivot low.

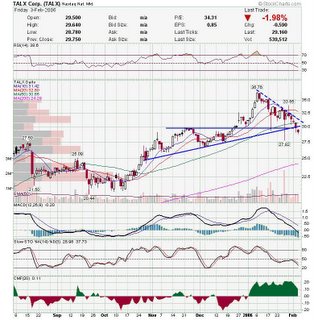

MMUS is a chart I highlighted a few days ago as a possible cup and handle base forming. I think this is the bottom of the handle (61.8% retrace) and that it will resume the uptrend here. Watch for a breakdownnear previous pivot low. TALX had defended the 50 day sma aggresively twice in the past few weeks, but failed to do so again. Now we have a broken trendline. This could be headed toward 200sma.

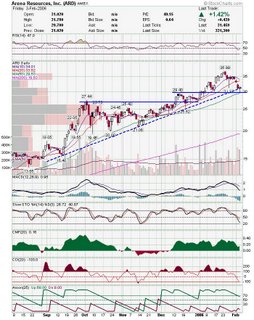

TALX had defended the 50 day sma aggresively twice in the past few weeks, but failed to do so again. Now we have a broken trendline. This could be headed toward 200sma. ARD is sitting right on support. Watch for a break to either side.

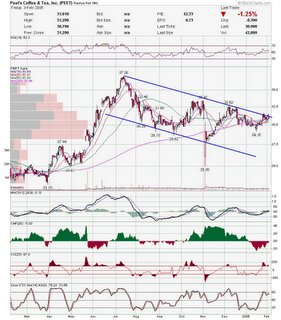

ARD is sitting right on support. Watch for a break to either side. PEET is right at top of channel and struggling to overcome resistance. Could be headed lower if it fails to hold SMA's.

PEET is right at top of channel and struggling to overcome resistance. Could be headed lower if it fails to hold SMA's.

If you're looking for more charts, swing by Roberto's Nasdaqtrader blog (link on my sidebar). He posted a bunch of charts this weekend.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment