Not much of note today other then another down day but on lighter volume.

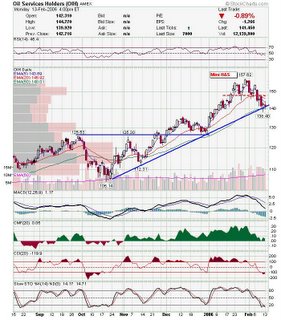

Energy stocks were hit pretty hard and OIH is at support. We may get a bounce back here as a lot of the energy stocks have quickly become oversold. If energy correction continues, ARD may be a short play. They broke support today and without sector support it looks like it will pull back further.

If energy correction continues, ARD may be a short play. They broke support today and without sector support it looks like it will pull back further. Same story with CLB.

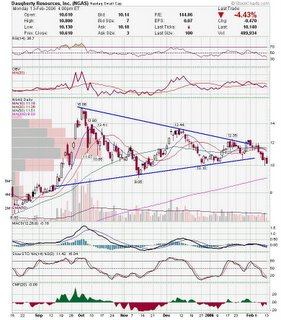

Same story with CLB. NGAS fell out of the triangle, but true support is near 10. If 10 falls it will probably head to 9 at least.

NGAS fell out of the triangle, but true support is near 10. If 10 falls it will probably head to 9 at least. JOYG is a market leader in the energy sector and have held up very well. They look like they will pull back a little further but are on my watchlist for a long entry.

JOYG is a market leader in the energy sector and have held up very well. They look like they will pull back a little further but are on my watchlist for a long entry. TRCI may be headed up after a quick consolidation.

TRCI may be headed up after a quick consolidation. DIET consolidating into a triangle like base.

DIET consolidating into a triangle like base. MNST has consolidated into an orderly bull flag since earnings breakout.

MNST has consolidated into an orderly bull flag since earnings breakout. SUF made the move up and not down, so can be played long with a tight stop IMO.

SUF made the move up and not down, so can be played long with a tight stop IMO.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment