Most of the indices have broken downtrendlines, but Nasdaq is lagging. If tech can't join the party this rally will be short lived. Semi's may carry NAS tomorrow on heels of AMAT earnings. Some of the semiconductors started ticking up after hours. Careful with options expiration looming this Friday. The speculator blog had a nice post tonight on some of the options expiration games to watch for. Lot's of decent looking charts tonight.

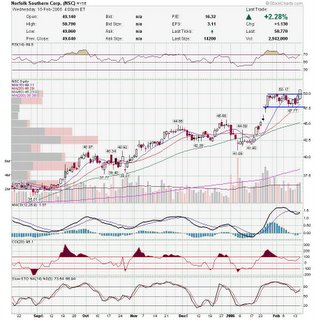

RBA is a low volume stock that broke through an orderly cup and handle base. NSC broke out of a bull flag today.

NSC broke out of a bull flag today. LVS has a nice looking chart. Today's volume was what you want to see when a stock breaks resistance.

LVS has a nice looking chart. Today's volume was what you want to see when a stock breaks resistance. CHRS also broke a cup and handle type base. Needs to clear the gravestone doji to follow through.

CHRS also broke a cup and handle type base. Needs to clear the gravestone doji to follow through. PHLY has had a very tight consolidation. This base reminds me of the starbucks (sbux) chart before the breakout.

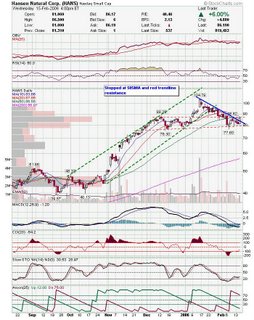

PHLY has had a very tight consolidation. This base reminds me of the starbucks (sbux) chart before the breakout. HANS looks good here but is up at resistance. If you pull up a 15 minute chart on HANS you will see a nice triangle break over the past 10 days. Looks like a prime candidate for a daytrade tommorow.

HANS looks good here but is up at resistance. If you pull up a 15 minute chart on HANS you will see a nice triangle break over the past 10 days. Looks like a prime candidate for a daytrade tommorow. OXPS is chugging along and may break overhead resistance soon.

OXPS is chugging along and may break overhead resistance soon. TALX looks like it will hold these lows as the bottom.

TALX looks like it will hold these lows as the bottom. CHS followed through today on it's breakout.

CHS followed through today on it's breakout. JOYG has been a horse this year. they had a good bounce off the trendline and fib retrace.

JOYG has been a horse this year. they had a good bounce off the trendline and fib retrace. Good Luck,

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment