Smallcaps have been hit hard lately, and while they are lagging the big boys, I think they may get a run this week. Here is my Russell chart. ABAX took a pretty steep pullback to trendline support and had a nice bounce.

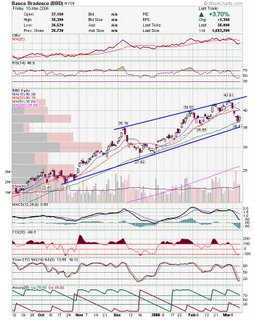

ABAX took a pretty steep pullback to trendline support and had a nice bounce. Emerging markets have also fallen, but BBD is still within the uptrend channel.

Emerging markets have also fallen, but BBD is still within the uptrend channel.

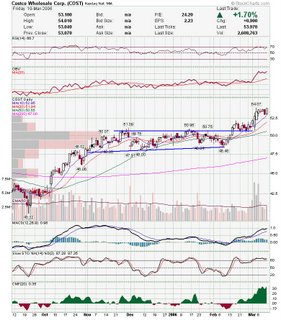

USG started to rise from the bottom of the current trading range. COST has been looking good.

COST has been looking good. PNRA is bouncing off the trendline and looks like it is breaking out of the current pullback.

PNRA is bouncing off the trendline and looks like it is breaking out of the current pullback. PAAS bounce off the lower trendline.

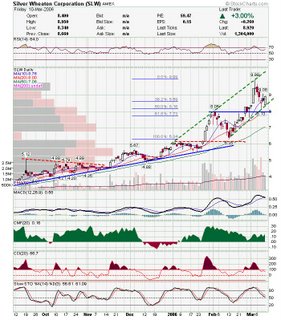

PAAS bounce off the lower trendline. Cramer is an idiot. Someone called in on the lightning round Friday, and he said something along the lines like how can you think GG and SLW are in the same class and that they should trade in to PAAS. Doesn't he realize that GG owns 62% of SLW?

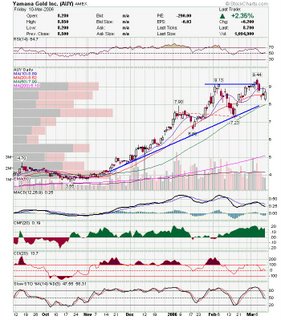

Cramer is an idiot. Someone called in on the lightning round Friday, and he said something along the lines like how can you think GG and SLW are in the same class and that they should trade in to PAAS. Doesn't he realize that GG owns 62% of SLW? AUY has held up OK as far as gold plays.

AUY has held up OK as far as gold plays. TTI barely defended it trendline at first, but came back strong.

TTI barely defended it trendline at first, but came back strong. BOOM is starting to get interesting.

BOOM is starting to get interesting. MNST had a nice bounce off the 50SMA.

MNST had a nice bounce off the 50SMA. GFIG looks like it may fall apart here.

GFIG looks like it may fall apart here.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment