Not sure what to make of the nasdaq weakness on Friday due to the games that are played on options expiration, but there are a lot of semiconductor stocks that reversed pretty hard. The indices are still holding support so the path of least resistance remains higher, however, the environment is still pretty dangerous being that most of the indices are at the top of their channels.

Here are a few IBD 100 charts that offer devent risk / reward trades.

ABAX looks good if they can clear the overhead resistance. ANDE bounced back pretty quickly after dipping a few days ago. Watch for a break to new highs.

ANDE bounced back pretty quickly after dipping a few days ago. Watch for a break to new highs. BER looks good here too after clearing this rectangle base.

BER looks good here too after clearing this rectangle base. CWTR broke the rectangle base and now may come back for a test of support.

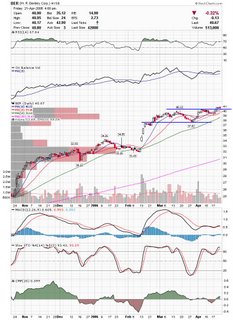

CWTR broke the rectangle base and now may come back for a test of support. ET looks good breaking out of this triangle. MACD is crossing over as well.

ET looks good breaking out of this triangle. MACD is crossing over as well. **correction: I labeled DW as GW below earlier.

**correction: I labeled DW as GW below earlier.

DW held above the breakout point on Friday and looks good if they can make a higher high on the daily chart. GOL cleared a pretty large triangle, but they need to hold the breakout area.

GOL cleared a pretty large triangle, but they need to hold the breakout area. INFA sold off after earnings, but came back by the end of the day to cut their losses by a pretty good margin. If they can clear 17 they may look good.

INFA sold off after earnings, but came back by the end of the day to cut their losses by a pretty good margin. If they can clear 17 they may look good. SCSS looks like they may take out upper resistance.

SCSS looks like they may take out upper resistance. THO has been consolidating fairly quietly, but if they can clear this triangle on volume, it should make for a pretty decent trade.

THO has been consolidating fairly quietly, but if they can clear this triangle on volume, it should make for a pretty decent trade.

Thats it for tonight. Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment