Well the week started off with a sharp reversal down and then a decent close. Things will undoubtedly get even more fun with a ton of earnings on the slate and options expiration to boot. I am only posting a few charts as I am still watching most of the charts I posted last night. With the day being so negative, 9 of the 11 longs I posted last night managed to close positive, so if the markets get any traction, those would be a good place to start.

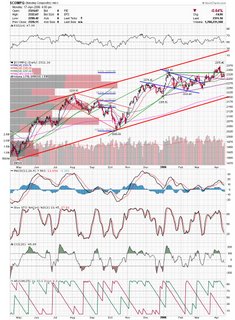

Here is an updated Nasdaq chart. It has been respecting the dotted trendline as support, so watch out if it breaks under it. DJIA bounced off the rising trendline today. Keep an eye on that trendline.

DJIA bounced off the rising trendline today. Keep an eye on that trendline. IBCA is a very thinly traded stock with a nice chart pattern.

IBCA is a very thinly traded stock with a nice chart pattern. ITRI had a nice move today and cleared all resistance.

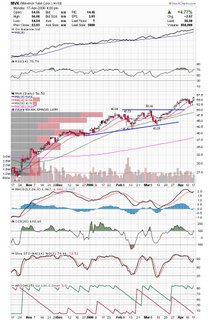

ITRI had a nice move today and cleared all resistance. MVK also cleared resistance and closed very strongly today.

MVK also cleared resistance and closed very strongly today. I am watching some possible short setups such as ESRX and FFIV, but I also get some with my real time scans. Here is a sample of some of the shorts that came up today. Most of these look like they will fall further.

I am watching some possible short setups such as ESRX and FFIV, but I also get some with my real time scans. Here is a sample of some of the shorts that came up today. Most of these look like they will fall further.

Shorts that triggered today

I took OSIP and RIMM today out of that list and covered for profits.

Good Luck tomorrow.

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment