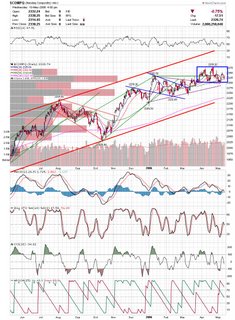

The Fed remained tight lipped and that may be a problem near term. The markets have been rallying on the assumption that Fed was near pausing rate increases and any thoughts otherwise have led pullbacks. The Dow is extended right now, although the chart is very bullish. All the indicators are confirming this latest breakout, but there may be a pullback here as they are overbought now. Another issue is the continuing problems with the Nasdaq. I had to scenarios I envisioned with the first being that the semiconductors would lead a rally. The other was that the Nasdaq would resolve into a head and shoulders top. I highlighted the H&S in a blue box. Kee in mind the pattern is not confirmed until the neckline is broken.

Another issue is the continuing problems with the Nasdaq. I had to scenarios I envisioned with the first being that the semiconductors would lead a rally. The other was that the Nasdaq would resolve into a head and shoulders top. I highlighted the H&S in a blue box. Kee in mind the pattern is not confirmed until the neckline is broken. Here is the Sox chart. I have two trendlines here that may offer support. Things don't look good however indicator wise.

Here is the Sox chart. I have two trendlines here that may offer support. Things don't look good however indicator wise. Here are a few charts worth looking at.

Here are a few charts worth looking at.

FMD is still holding between support and resistance. They had a doji at support today and a higher high on the daily may signal a buy. GFIG is pulling back to the breakout area. Watch for confirmation as support.

GFIG is pulling back to the breakout area. Watch for confirmation as support. NSC looks to be breaking out of a triangle base here.

NSC looks to be breaking out of a triangle base here. SIRF looks like a text book short here, but good luck finding shares. They do trade options so puts may be your best bet.

SIRF looks like a text book short here, but good luck finding shares. They do trade options so puts may be your best bet. COH broke below the previous pivot low today and may be headed to 28-29.

COH broke below the previous pivot low today and may be headed to 28-29. Right now the best thing to do is to stay cautious and don't press your positions. I will be waiting tomorrow to see how things shake out before deciding if I need to shift to a more bearish stance.

Right now the best thing to do is to stay cautious and don't press your positions. I will be waiting tomorrow to see how things shake out before deciding if I need to shift to a more bearish stance.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

Alot of other rail roads are in a similar position as NSC: UNP, CSX, CP, RAIL and of course TRN which is on fire.

RAIL appears to be the leading stock in the larger cap rail ways.

Transports have been kicking butt and I agree that Rail is definitely one of the better ones.

DT