I can't overstate how weak the Nasdaq tech stocks have been. Chips have been a real drag on the market and the Nasdaq was the first index to breach the lows of the Fed day rally. We are close to seeing if the markets will rally in July or if the downtrend will start to pick up steam again. Here are a few charts to check out.

FMD had a pretty nasty drop last week and it looks like the dead cat bounce is over. OII may be getting support witnessed by the spinning top at the 20sma and previous breakout area. Spinning tops are a candles that have long wicks and small bodies. They signal indecision which can be an early clue that a trend may be ending.

OII may be getting support witnessed by the spinning top at the 20sma and previous breakout area. Spinning tops are a candles that have long wicks and small bodies. They signal indecision which can be an early clue that a trend may be ending. AMLN wants to break resistance and were pretty strong today.

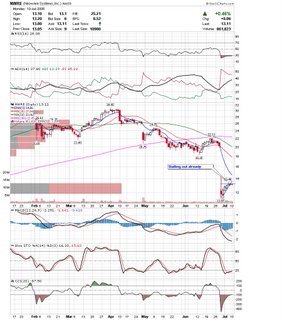

AMLN wants to break resistance and were pretty strong today. NWRE is stalling fairly quickly after trying to retrace into the gap down.

NWRE is stalling fairly quickly after trying to retrace into the gap down. CHH may be breaking out of a bull flag here.

CHH may be breaking out of a bull flag here. EYE formed a doji at support via the trendline and 9ema today. This could be a signal that they will bounce back here.

EYE formed a doji at support via the trendline and 9ema today. This could be a signal that they will bounce back here.

Good Luck and be extra careful the next few days.

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment