The end of quarter effect usually lasts 2-3 days into the next month as funds invest monthly contributions, so it will be interesting to see what takes place the next few days. The daily charts are still overbought, but there are some interesting patterns developing on the hourly charts with the SPY looking pretty good to me, but Q's looking a littlw worse. Picking tops is difficult so I am sticking with long charts until we see some further breakdowns.

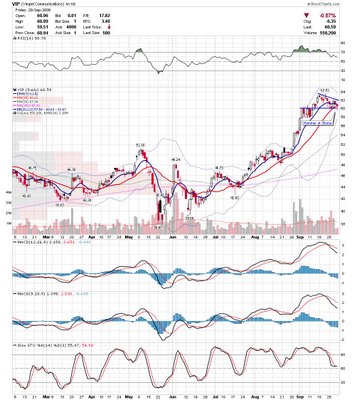

VIP may be finding support at the 20sma as the bollinger band tries to catch up. SYKE tried to breakout friday and finished just under the trendline. MACD looks weak but if it can clear resistance on volume, then the indicators will take care of themselves.

SYKE tried to breakout friday and finished just under the trendline. MACD looks weak but if it can clear resistance on volume, then the indicators will take care of themselves. OXPS is coiling tightly here as trendline converge.

OXPS is coiling tightly here as trendline converge. NEU has been holding the 50sma as support and is testing the downsloping 20sma. Watch to see which way it breaks.

NEU has been holding the 50sma as support and is testing the downsloping 20sma. Watch to see which way it breaks. IHS has a nice narrow range candle that may offer a somewhat safe entry.

IHS has a nice narrow range candle that may offer a somewhat safe entry. ICLR is starting to push the upper bollinger band as it breaks resistance.

ICLR is starting to push the upper bollinger band as it breaks resistance. DK has been trading a pretty volatile range and is up against a descending trendline.

DK has been trading a pretty volatile range and is up against a descending trendline. Buying TAM at the 20sma has been working and has printed a nice narrow range candle on declining volume right smack dab on the 20. Keep an eye for the next higher high.

Buying TAM at the 20sma has been working and has printed a nice narrow range candle on declining volume right smack dab on the 20. Keep an eye for the next higher high. TRID is sitting on major support here with the 200sma meeting the ascending trendline.

TRID is sitting on major support here with the 200sma meeting the ascending trendline. BLUD is trading a nice Bull Pennant and may bounce off the 20sma.

BLUD is trading a nice Bull Pennant and may bounce off the 20sma. CXW may be finding support at the ascending trendline but still has plenty of resistance to work it's way through.

CXW may be finding support at the ascending trendline but still has plenty of resistance to work it's way through.

A couple of links worth reading

- JC had a great review of the past month

- Fallond's weekly Stockcharts roundup

- Jamie thinks we may be in for a pullback

- I uploaded another pic on the other blog

DT

0 comments

Post a Comment