Keeping a journal is one of the most effective ways to get better at trading, period. Many beginning traders, and I would suspect, failing traders, think that keeping a journal is just a hassle, but it is the most effective learning tool I have ever used. It's nice to learn about indicators and trading methods, but they are useless if you have no way of knowing how well they have worked for you. Knowing what is working or more importantly, being able to go back objectively and see what is not working is extremely valuable.

Oliver Velez (founder of Pristine.com) had an interesting way of tackling trading problems. Identify a weakness in your methodology, and resolve to only fix that weakness. Focus on not making that specific mistake for as many trades as it takes until it is weeded out of your system. Then, tackle the next. None of this is possible without an objective way of reviewing your trades to identify those weaknesses. Keeping a journal is one of the key ingredients of a comprehensive trading plan. I don't remember where I read this quote, but the gist of it was, that the author had NEVER met a great trader who wasn't obsessed with keeping score and tracking their statistics. Regardless of the style of trading, each had an obsession with tracking their results.

Dr. Brett Steenbarger published a link to an excerpt of his new book, Enhancing Trader Performance a couple days ago. In it, he tries to find the common factors in "expert performers" across a multitude of fields. One of the concepts mentioned is "deliberate practice". I am familiar with this concept from my experience in sports, and the basic idea is that practice is more effective when a specific goal is targeted in a deliberate manner. Go to a golf range and watch how most people just mindlessly swing away. The effective way to practice, would be to practice with a specific goal in mind, such as fading the ball into a specific spot with your 4 iron, and then practicing that shot until you get it right. Then practice it some more. The key is to consistently receive feedback and adjust technique. Once you are comfortable with the technique, you ingrain it to memory. In trading, systematically reviewing your trades, and then modifying your technique is one form of deliberate practice. But you need to have a way of reviewing your trades.

I recently started using Stocktickr's journal service to keep track of my trades. I used to keep a complicated and convoluted spreadsheet for my trades, but I found myself constantly neglecting the entering of my trades, and once the backlog was too much, I would just not enter them. Another problem was that once I got around to entering the trades, I couldn't remember much of the detail surrounding the trades. I tried downloading my trades and keeping them on a spreadsheet, but matching lots and then keeping track was too much of a hassle, so I neglected it as well. I also tried to run these complicated excel bar reports and then just stopped looking at reports all together. Stocktickr has worked out great so far. I like having an interface where I can just enter the details and click submit. Stocktickr also allows you to assign tags to your trades and then run reports against the tags.

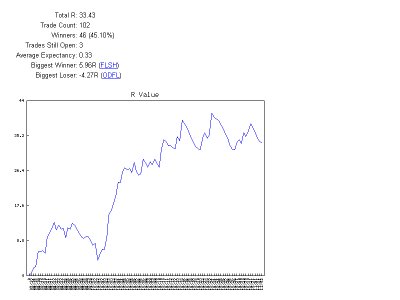

It also tracks R performance. For those that have missed the raging debate about the value of R, R is basically a concept where R = initial risk for a trade. For instance, if you risk $100 on a trade then that is your R. If you close the trade for $200 then you made 2 R. R has differing value depending on how you trade or keep track of performance, but it is decent way to gauge if you are consistently making more then you risk per trade. I vary my R depending on market conditions or trading performance, but I still find R valuable. R is then combined with win/loss ratio to create an expectancy. Stocktickr keeps track of all this and allow you to chart the results for different tags. Here is a better explanation of R and expectancy. Below is a chart of my R performance for the last month and a half or so. I am at 102 trades so far, so I feel like I have a decent sample to start working off.

Looking at my trading, I am under a 50% win rate, so I better darn well win more when I'm right, then I lose when I'm wrong. Looking at my trades, I only had a few where my loss was greater then 1R or where my R was too high, so I'm not lifting stops or risking too much for the most part. The ODFL trade above was at less then half my usual R so the overall loss was not too bad. What I did notice, was strings of consecutive losses and several "cut my winners short" trades.

Tracking your stats like this helps you determine how effective your trading methodology is and where it can improve. There are three ways to improve your bottom line.

1. Be right more often: In other words, increase your win rate by either being more selective, or improving your trading plan.

2. Bet bigger: If you have a methodology that is working well, then increasing your bet with a positive expectancy will increase your bottom line.

3. Improve on efficiency (Risk/Reward): This can be simply stated as letting your winners run longer and cutting losers short more efficiently.

I am resolving to fix my consecutive loss issue first which would fall under category one. I have a tendency to get frustrated when I lose a couple trades and then take subpar setups in order to "make back my loss". So when I miss a few trades in a row, I need to be more selective and reduce my R size. I had a better month as a percentage of my account, then I did R wise, and that is attributed to betting larger R's on long positions when the Nasdaq was rallying off support. I reduced R on short positions or when markets were extended to limit risk when I was unsure of market direction. This skews my R statistics because R is not a fixed value, but I still feel there is value to tracking R.

The second component of my journal is a chart review. I keep a chart for every trade I make so that I can review my entry and exit. Here is a post on some trades I made and my review of them.

I would like to plug Dave and Richard at Stock Tickr as well. Here is how they describe what Stock Tickr is: "StockTickr is a free portfolio tracker with an important twist: all watchlists are shared among all users! There are hundreds of users sharing their watchlists right now via StockTickr."

They have been constantly improving the product by implementing several changes recently, such as enhanced reports and changes to the trading journal. There are reports tracking how you perform per day of the week, monthly performance, and performance by tag. They have also implemented scaling in to positions and will soon be implementing the scaling out portion as well. They have also been open to suggestions from users in an effort to keep improving the product. While there are many ways of keeping a journal, I highly recommend the journal portion of stocktickr's service.

Hopefully I haven't rambled too much, but the key point I'm driving at here is that keeping a journal has been one of the most helpful things to my trading.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

Watch for a possible next version that combines Stocktickr and Trade-Ideas. Gee, who would want to leak something like that?

I am also wondering how one gets below -1R. The R value has no meaning if you are not willing to respect its dollar value.

One possibility for having more than 1R loss is order entry mistake, for example in quantity or stop loss price. Happened to me before, I recorded that trade as -2R.

There are several ways to get below -1R. Some are due to discipline problems and some are just bad luck. For instance, you can have a position gap against you (especially as a swing trader vs day trader). You can also incur excessive slippage in thin stocks which has happened to me several times. As far as discipline issues, if you pull a stop, or add to your position and therefore increase your risk to unacceptable level are possible causes. Hope this helps,

DT

Well I always think Keeping a trading journal is time consuming initially, but once you get into it, it becomes very easy and second nature.

emini trading