In a previous post I detailed how I keep a chart of my trades for review purposes. Here are a few trades I have taken recently, good and bad.

Silver Wheaton Corp. (USA) (Public, NYSE:SLW)

SLW has been one of my better trades, although I still made a mistake. I had been bullish on SLW as it held up very well through the correction in precious metals. The miners started to turn before the metals, and SLW offered a couple trades. I made a trade on the first bounce to the 20sma for a decent chunk, and then made a longer term trade on the subsequent pull back.

On the first trade, I traded off the second hammer confirming the 200sma as support. I exited into the declining 20 and 50 smas.

On the second trade, another hammer formed, this time on the bollinger band that had turned up, also confirming support at a previous resistance trendline. I expected a stronger move this time, and added on a few dips. I scaled out as it met resistance.

What did I learn?

- My bollinger band plays have been working out very well, and is a strategy I am exploring further.

- I exited too early, as SLW didn't give me a valid sell signal. My plan was to hold some until the move was over, and I exited when GLD met resistance.

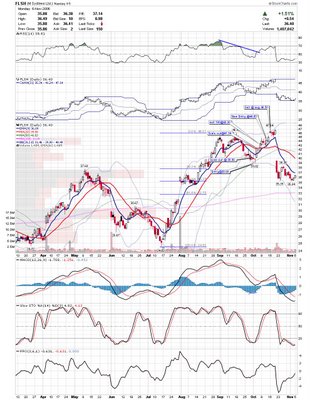

msystems Ltd. (Public, NASDAQ:FLSH)

FLSH was also a very good trade in R terms and bottom line profits. This was another Bollinger Band Bottom trade. I entered on an intraday chart and put in a large position. I sold some right away to reduce overnight exposure especially considering nothing was confirmed yet. I took profits at the 20sma (mid band) as per my strategy and then exited the rest a few days later. If I remember correctly, I exited after an intraday reversal. I re-entered a few days later later after it started bouncing off the 9 ema and exited on a gap up the next day over the top of the band.

What did I learn?:

- This was another succesful Bollinger Band play.

- Try to hold on to at least a portion of the trade in case it travels the entire Bollinger band.

- Take advantage of luck (took profits on gap up after clear signs of stock being tired)

So those were two trades that obviously worked out well. Here are a couple trades that didn't work out for whatever reason.

SINA Corporation (USA) (Public, NASDAQ:SINA)

First up is SINA. This is one where I was right on the overall direction but entered early. My first entry was as it touched the lower band and made the first turn higher. I was stopped out fairly quickly, and entered a few days later. I sold a little as it backed off the 20sma and was stopped out two days later. It was a losing trade which I'm ok with. I know I will be wrong half the time I trade and my plan accounts for that. The mistake I made was taking it off my radar as it setup very nicely a few days later. While I wouldn't of caught the entire move, as some of it was earnings related, I would of had a nice gain if I would of waited for the second touch of the band.

What did I learn?:

- I've noticed that a lot of times when a stock dips and reverses, it will make a second trip down to retest support. This is the highest probability play, so I need to be patient and not jump on it right away.

- Keep an eye on trades even if I miss them or get stopped out, as I may of been right on trend and wrong in timing.

Hansen Natural Corp. (Public, NASDAQ:HANS)

HANS is the second losing trade and was one of my worst in quite some time. I think the play was decent, and I entered at the right time, but I took an excessive risk based on my market expectations and the thought that this would be a big winner.

I entered HANS as it traded narrow range candles after a hammer on the 20sma. The entry was as it made a higher daily high near the down trendline. It moved in my favor and I was up nicely, but it stopped cold at the 200sma and reversed the next day. It lost the 20sma the day after that and has had a healthy decline since then. I only lost 1R on the trade, but I had increased the R size for this trade making it my biggest loser in 2 months.

What did I learn?:

- Scale out partially at major resistance areas. I tend to do this but I got greedy and paid for it.

- Don't take excessive risk.

- I should of considered this a short play at the point the breakout failed. It had a nice entry as it bounced back to 20sma and failed.

So there you have it. Only 4 trades of over 100, but each had some good lessons in there. Mostly though, the good trades are reinforcing good behavior, and I am learning from my mistakes. One key to point out is that you can have a good trade lose money, and a bad trade make money. As a matter of fact, my best bottom line trade was a play in GLG where I lifted my stop. Although I was right, it was a terrible decision where I was lucky because of my analysis of the sector. Be honest with yourself as you review your trades and acknowledge when you make even profitable mistakes. If you don't realize that you made a mistake, eventually you will give all that money back as you reinforce negative trading habits.

As for todays markets, we had a strong move earlier in the day followed by some weakness in the afternoon. While the indices didn't rollover, they did close with shooting star type candles, especially on the Russell. These came at resistance, so we need to be careful until todays highs are cleared. We will see how they spin it with elections results tomorrow.

Good Luck,

DT

0 comments

Post a Comment