Today resulted in a narrow range day for most indices. It is starting to look like the rest of the indices will follow the S&P to new highs soon. While most have been looking for the correction to resume, the markets have had a different idea, punishing the bearish majority. I'm still of the opinion that we are grinding out a large top, but I will let price dictate how I trade.

Here is a chart of the Q's showing some more bullish signs. RSI is breaking a sloping trendline, making new highs with price. MACD is starting to make new highs and now there are two closes over the previous bearish gap resistance.

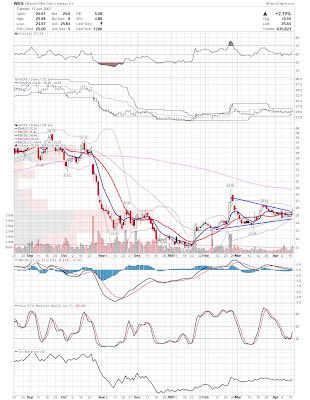

VNDA has been having some weird intraday action recently with large block buys followed by very low volume pullbacks. While I tend to ignore this noise, the daily chart is starting to round up. MACD is in a leading divergence and volume is starting to tick up.

No new stocks on the list tonight as I am fully positioned right now. Also, don't forget options expire later this week.

Good Luck,

Joey

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment