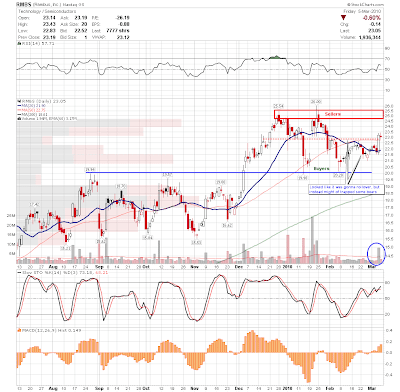

It looks like Rambus, Inc.(NasdaqGS: RMBS) might be close to squeezing some shorts based on the recent price action. With over 11% of the float being short, and a history of quick powerful moves, this is a situation that bears watching. Overall, RMBS cleared a 6 month long base in December, and has been trading in a wide range since then. It seems every time RMBS manages to rally into the $25.50-$26.00 range, it is met with an onslaught of profit taking or short selling. It then falls back towards the original breakout area near $20, where there is no shortage of buyers.

It looked like RMBS was in the process of forming a double top over the first three months of this year. It had a weak bounce in February that only managed to reach the 50-day moving average near $23 where it began to rollover. It looked like RMBS would head back down to test the $20 area again, only this time with momentum on the side of the sellers. However, RMBS didn't breakdown. It began trading sideways until surging past the small consolidation near $23 possibly trapping some early bears. This move was also accompanied by a surge in volume. While RMBS still has plenty of overhead resistance, this move could be helped by a short squeeze if indeed this is a failed topping pattern. It looks like a retest of $26 is in the works as long as RMBS can hold above $22.50-$23 in the immediate future.

With the long history of surprise news due to the ongoing patent litigation in RMBS, traders may wish to look at options for protection or even as a substitute for common shares. Overall the pattern looks very constructive, but there is always a chance of an unseen news event in this stock.

Good Trading,

Joey

blog comments powered by Disqus