Most sites post stock picks, but you never hear what happened to the trades, so I'm gonna try and go through my thought process on three current holdings. I've chosen stocks that I'm still in, as opposed to stocks that I got stopped out of such as BRCM or SVA. Also, I feel that these stocks are still playable. I am also highlighting a new stock that looks like a possible swing setup for this week.

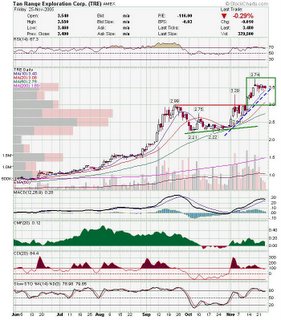

NGPS: My plan was to give this one a little room because the reward greatly outweighs the risk. I feel that NGPS can trade to $36 based on the double bottom base. It also broke through a long downtrend. I'm keeping my stop below the 10 day sma at this point and I may add if it makes a higher high. TRE: I bought this at 3.19 and had an initial target at the upper range of the box ased on the triangle breakout. I took profits on half of my position at 3.69. I bought those shares back and a few more at 3.40. The reason I bought the shares there was that my stop at the time was 3.30. I sometimes buy more shares when the stock pulls back to my stop, because I choose my stops based on where I feel support will be and the risk reward justifies adding there IMO. Not all trades work out and I get stopped out plenty of times. But when it works, the reward is usually substantial. I think TRE is geting close to moving higher again. They have pulled back gently to the 10 day sma and near the trendline. Look down the chart and see what happened last time this happened.

TRE: I bought this at 3.19 and had an initial target at the upper range of the box ased on the triangle breakout. I took profits on half of my position at 3.69. I bought those shares back and a few more at 3.40. The reason I bought the shares there was that my stop at the time was 3.30. I sometimes buy more shares when the stock pulls back to my stop, because I choose my stops based on where I feel support will be and the risk reward justifies adding there IMO. Not all trades work out and I get stopped out plenty of times. But when it works, the reward is usually substantial. I think TRE is geting close to moving higher again. They have pulled back gently to the 10 day sma and near the trendline. Look down the chart and see what happened last time this happened.

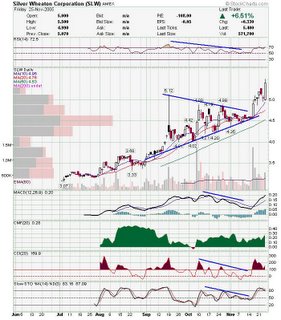

SLW: This is one that I screwed up on early, but I bought it back when I saw I was wrong. I let this one get away from me on the first breakout day out of the triangle. I chased it a little, but still bought where I thought was decent (4.85). It traded to resistance and I didn't get filled. I had my stop at 4.90 and was stopped on the hammer day (next day). When it traded higher the next day, I felt that the hammer would be the low for this pullback, so I bought back my position at 5.12. I then bought more at 5.00 the Wednesday because it was close to my stop and I fel there would be support. I am still holding this as I think this is the start of a new leg up. I am keeping my stop below Fridays low for tomorrow and will adjust accordingly tomorrow night. CMT: They are trading in a loose bull pennant. If the upper trendline is broken it can be played. If 8 is broken then this could get exciting. 10 day crossed the 200 and 20 is trying. Keep an eye on it.

CMT: They are trading in a loose bull pennant. If the upper trendline is broken it can be played. If 8 is broken then this could get exciting. 10 day crossed the 200 and 20 is trying. Keep an eye on it. Also on my watch list for the week are lmia,cbg,iiji, ipii,antp, rnwk,sva,mrvl, brcm,qcom.

Also on my watch list for the week are lmia,cbg,iiji, ipii,antp, rnwk,sva,mrvl, brcm,qcom.

Good Luck,

DT

Strategy for three current positions

Posted by downtowntrader | 11/28/2005 01:27:00 AM | 0 comments »

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment