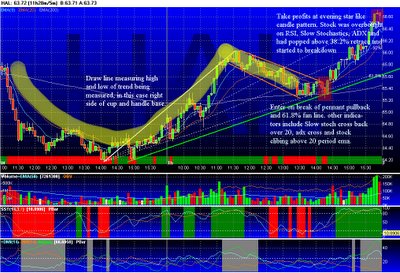

Fibonacci Fans are one of the tools I use to try and find areas of support and resistance to either go long or take profits. I try to find areas where support or resistance would normally be found, as well as look for a convergence of signals from my indicators. Here is an example of a trade I took where almost everything lined up very nicely. HAL had closed while forming a double bottom. The next day it built the right side of a cup and handle (shown in yellow) on the intraday 5 minute chart. I started watching it as it was pulling back and forming the handle. Since the low and high were defined at that point, I drew a line connecting the two, and looked at the fibonacci fans it formed. If your platform doesn't support fibonacci tools, I recommend looking at medved quotetracker. It has a free version as well. It looked like HAL was respecting the fib fans on the pullbacks so I watched as it pulled back after lunch. Everything came together where I drew the red square. First HAL started finding support at the 200 period ema. Second, the Slow Stochastics crossed back into normal territory from oversold. There was an ADX crossover and HAL reclaimed the 20 period ema at the same time it was breaking the resistance line from the pullback (shown in orange). The fib fan confirmed everything as it was a 61.8% retrace. The fib fan also accurately showed resistance at the 50% and then the 38.2%. The other factor which is often overlooked is what time all this happened. I have much more faith in a breakout starting at 2:00pm then sometime between 11:30 and 1:00. One could of taken partial profits once HAL started to fight with the 50% retrace but it never seriously threatened the 20 period ema after it broke out. The trade was closed after it pulled over the 32.8% fan line and then formed an evening star like pattern. It was also near 4:00pm, so it was a convenient exit. I use fib. fans almost exclusively on intraday charts but once in a while check it on daily charts. Here is an example of the Nasdaq composite showing a fib. fan. There is some subjectivity as to where the high and low of the trend are, and I chose the first high here, before it started trading sideways. The composite has been trading sideways for about 17 days now and should start a move to either direction soon. The bollinger bands are tight and the 10 and 20 period sma's have converged with an ascending trendline. I am looking to the fib fans as potential support if it breaks down.

I use fib. fans almost exclusively on intraday charts but once in a while check it on daily charts. Here is an example of the Nasdaq composite showing a fib. fan. There is some subjectivity as to where the high and low of the trend are, and I chose the first high here, before it started trading sideways. The composite has been trading sideways for about 17 days now and should start a move to either direction soon. The bollinger bands are tight and the 10 and 20 period sma's have converged with an ascending trendline. I am looking to the fib fans as potential support if it breaks down. Now an important observation I haev made, is that fib fans don't act as classic trendlines do. They are more like magnets and the stock tends to trade around them. So if it breaks one it will either trade a few days hugging the opposite side of the line, or it will fall back (or up) near the next line. I never rely on just fib fans, but they are useful if you are looking to confirm your own trendlines or indicator analysis. Good Luck out there,

Now an important observation I haev made, is that fib fans don't act as classic trendlines do. They are more like magnets and the stock tends to trade around them. So if it breaks one it will either trade a few days hugging the opposite side of the line, or it will fall back (or up) near the next line. I never rely on just fib fans, but they are useful if you are looking to confirm your own trendlines or indicator analysis. Good Luck out there,

DT.

I will post an update on what I'm watching later tonight.

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment