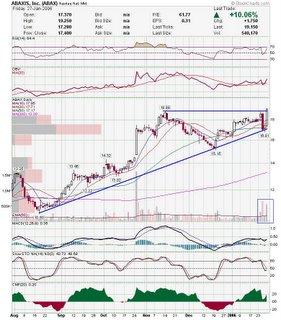

Lots of charts tonight, and most look very good. Not sure if this is foretelling for the market. I think we are in a precarious position here as far as market health is concerned. I would be worried about a top here, until the markets prove otherwise and make new highs. I am being quick to take profits on some of my newer positions.

NWRE: May be breaking out here. Earnings are 2/1 Nice bounce off the lower trendline here.

Nice bounce off the lower trendline here. long consolidation for esrx.

long consolidation for esrx. Nice volume for BNT as it takes out resistance.

Nice volume for BNT as it takes out resistance. CTRN also has had a good volume increase.

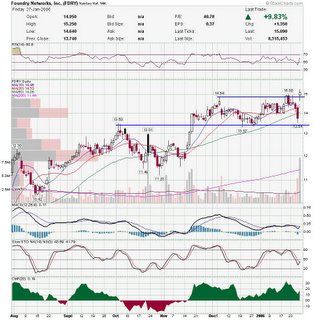

CTRN also has had a good volume increase. FDRY also had volume as it breaks a trendline and earnings are out of the way.

FDRY also had volume as it breaks a trendline and earnings are out of the way. NTRI has possible resistance above, but has been a high flyer before.

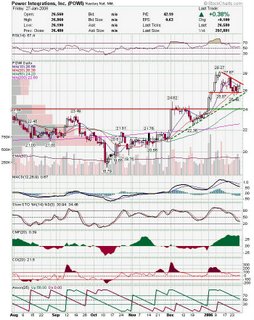

NTRI has possible resistance above, but has been a high flyer before. POWI may break out of a pennant type formation.

POWI may break out of a pennant type formation. Another pennant type formation here for QCOM.

Another pennant type formation here for QCOM. BOOM has been trading in a tight range and just broke to a new high friday. MACD crossing over.

BOOM has been trading in a tight range and just broke to a new high friday. MACD crossing over. CMED pulling back to a possible trendline.

CMED pulling back to a possible trendline. SWSI is a thinly traded stock that has broken a trendline and is now testing support. Looks like it is headed back to test the high.

SWSI is a thinly traded stock that has broken a trendline and is now testing support. Looks like it is headed back to test the high. ZYGO broke out but reversed. Look for a test of the trendline and a possible reversal back up.

ZYGO broke out but reversed. Look for a test of the trendline and a possible reversal back up.

Lot's of charts to digest, but I'm sure some of these will be nice movers this week.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment