CKCM was one of my friends (btuff) top picks for this coming year. This guy really knows how to find undervalued companies and has found boom, hurc, ftk, lmia, amongst others, long before they truly broke out. I have been watching CKCM for a break of the upper resistance line for a few months now and have traded it within the larger triangle. I believe CKCM broke the descending upper trendline and only needs to break the parallel (52week high) resistance for a very nice breakout trade. The stock is already up on the year, but this could only be the beginning.

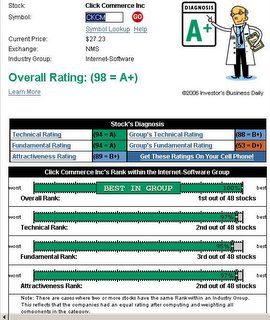

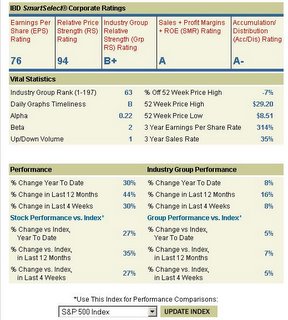

CKCM is a very highly rated stock on IBD. Once a stock starts moving, IBD tends to start running articles profiling it and mentioning it in their paper. They are ranked number 1 in their sector and the sector has been a good performer. Here is what's below the hood on the IBD rankings.

Here is what's below the hood on the IBD rankings.

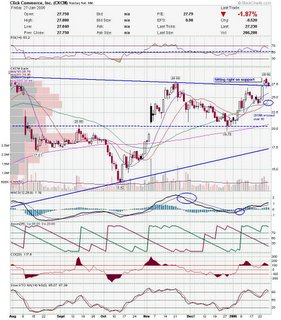

Here is something I find very intriguing. The short position is HUGE on CKCM. It is larger then BOOM, TASR, or even TZOO in a days to cover ratio. If I was short, I'd be nervous as hell with CKCM trading near a 4 year high and with earnings coming up on 2/16. CKCM has released some positive news lately (new contracts) and the stock has been reacting favorably. Here is the daily chart. The upper sloping trendline from a larger triangle has been broken. There is still resistance to 29.20 and CKCM is still in the process of testing the trendline as support. The 20SMA just crossed over the slower 50SMA.

Here is the daily chart. The upper sloping trendline from a larger triangle has been broken. There is still resistance to 29.20 and CKCM is still in the process of testing the trendline as support. The 20SMA just crossed over the slower 50SMA. Here is the daily from a fibonacci fan perspective. While CKCM is by no means in the clear, they are attempting to break the horizontal trendline and trade near the 50% fan line.

Here is the daily from a fibonacci fan perspective. While CKCM is by no means in the clear, they are attempting to break the horizontal trendline and trade near the 50% fan line. The weekly clearly shows a break of the trendline resistance. RSI has been sloping down as it consolidates. I wouldn't count this as the typical negative divergence as CKCM is really trading sideways and not up on the weekly. RSI is near breaking the trendline resistance as well.

The weekly clearly shows a break of the trendline resistance. RSI has been sloping down as it consolidates. I wouldn't count this as the typical negative divergence as CKCM is really trading sideways and not up on the weekly. RSI is near breaking the trendline resistance as well.

Now for my disclaimers. I really don't like they way CKCM trades. It is very volatile and for those trying to daytrade it, there is a tendency to get chopped out. I think there is a realistic chance that CKCM could fail, but it looks to me like most charts are showing strength, and with earnings coming soon, and the huge short position, CKCM has more reward then risk at this point. I have already taken a position in CKCM and will add if it breaks my resistance lines. Please do your own DD. I will be adding some fundamental analysis from btuff in the coming day or two. Also, I will post my usual charts later tonight.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment