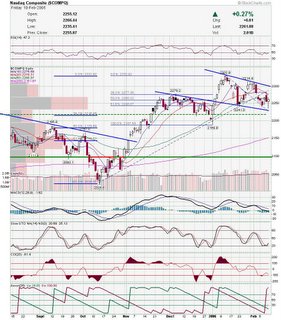

Nasdaq was setting up for a test of the upper trendline but Barons goog article has the chance to drag the nas down tomorrow. However, I think if the nas and goog in particular opens weak, there is a chance it will rebound and close strong. Looking at the charts this weekend, there is not a whole lot standing out to me. I have a lot that look like possibilities, but usually I have a few that really stand out. I also included more short setups as the market may be weak. I expect the market to be more choppy then trending this week, so I will focus on 1-2 day trades.

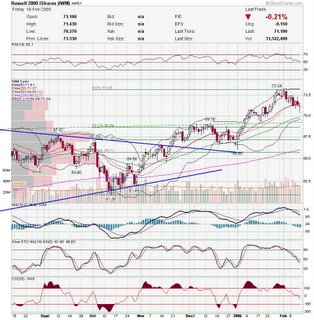

Here is the nasdaq chart. Pay attention to the two different fib retrace levels and the trendlines that may be possible support and resitance. I noticed early last week that IBD 100 stocks were getting hammered. IWM which leads most small caps is looking like it will correct a little. IWM and small caps in general have been the true market leaders of the current bull rally and if they break down, then the writing is clearly on the walls. There is a chance that we are seeing the beginning of a sector rotation out of small caps to large caps, as usually happens in high interest rate environments. The underlying thought is that small caps are more sensitive to the cost of borrowing money and EPS and growth would suffer for them more then the blue chips. Still, we remain in a low interest rate environment and the overall trend is still up for small caps.

I noticed early last week that IBD 100 stocks were getting hammered. IWM which leads most small caps is looking like it will correct a little. IWM and small caps in general have been the true market leaders of the current bull rally and if they break down, then the writing is clearly on the walls. There is a chance that we are seeing the beginning of a sector rotation out of small caps to large caps, as usually happens in high interest rate environments. The underlying thought is that small caps are more sensitive to the cost of borrowing money and EPS and growth would suffer for them more then the blue chips. Still, we remain in a low interest rate environment and the overall trend is still up for small caps. Here is a fib fan of SUF that I found interesting. Look at how SUF is holding the 61.8% retrace fan. I would watch for a break either way.

Here is a fib fan of SUF that I found interesting. Look at how SUF is holding the 61.8% retrace fan. I would watch for a break either way. TALX is still fighting support and resistance. Looks like it will fall to me, but I would wait for the break.

TALX is still fighting support and resistance. Looks like it will fall to me, but I would wait for the break.

CVCO looks good here. DRQ looks like it will find support here at the trendline and 50sma.

DRQ looks like it will find support here at the trendline and 50sma.

MSTR looks like it may break down here. Watch for a break of the trendline, and then the 50 sma. PARL tested it's breakout area for support and looks like it held. Watch for a higher high.

PARL tested it's breakout area for support and looks like it held. Watch for a higher high. UPL looks like a failed triangle breakout.

UPL looks like a failed triangle breakout. VLCM may follow through.

VLCM may follow through.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment