I wasn't around today, but it appears the markets didn't like what the Fed had to say. Most things pulled back but there was some pockets of strength out there. What will be interesting to see is that everyone expects a pullback now, so will the markets trap some bears and go up instead? I started off the night searching for shorts and was surprised to see strength where I least expected it..... home builders. Keep reading for charts.

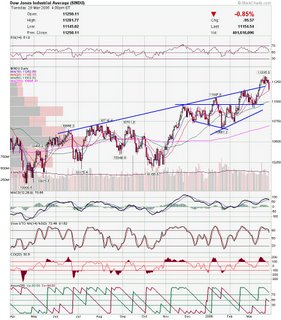

Here is the DJIA daily chart. Cleary failed to hold support. Russell held up and is still above support.

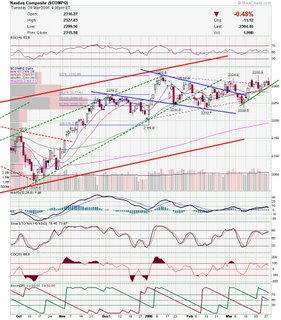

Russell held up and is still above support. Same for Nasdaq who showed more strength then DJIA.

Same for Nasdaq who showed more strength then DJIA. Gold looks like it may fail at the trendline, but it looks like it will pull back to near 20sma and then pop back up.

Gold looks like it may fail at the trendline, but it looks like it will pull back to near 20sma and then pop back up. BBD has a nice head and shoulders forming with neckline shown in red.

BBD has a nice head and shoulders forming with neckline shown in red. Here is the first home builder chart. This chart still looks weak with trendline resistance still holding the stock down, however, todays news should of killed the home builders and DHI got some support late in the day.

Here is the first home builder chart. This chart still looks weak with trendline resistance still holding the stock down, however, todays news should of killed the home builders and DHI got some support late in the day. Here is the LEN chart. Looks like a reverse head and shoulders to me. Failed to hold the neckline though.

Here is the LEN chart. Looks like a reverse head and shoulders to me. Failed to hold the neckline though. Here is another reverse head and shoulders pattern, also still below the neckline for BZH.

Here is another reverse head and shoulders pattern, also still below the neckline for BZH. CHK cleared the little triangle it as forming.

CHK cleared the little triangle it as forming. CCJ is a possible short setup. Looks like downtrend may be accelerating.

CCJ is a possible short setup. Looks like downtrend may be accelerating. Watch FDG for another break of the previous trendline.

Watch FDG for another break of the previous trendline. ISIL may be forming a bear flag.

ISIL may be forming a bear flag. LMS showed some strength today, but would be a short if it fails at this trendline.

LMS showed some strength today, but would be a short if it fails at this trendline. PBR is testing the lower end of a base and is looking weak.

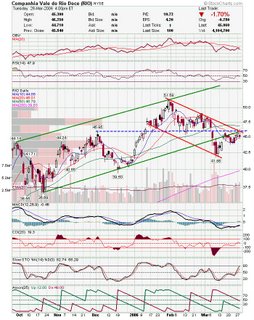

PBR is testing the lower end of a base and is looking weak. RIO has all sorts of resistance above.

RIO has all sorts of resistance above. UPL also has a little reverse head and shoulders here, not too unlike the one OIH just broke out of.

UPL also has a little reverse head and shoulders here, not too unlike the one OIH just broke out of.

Good Luck tommorrow,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment