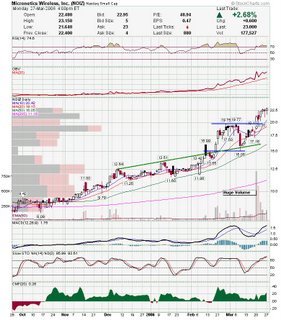

I plan on taking most of tomorrow off from trading with FOMC meeting taking place. I will only manage my open positions. I find that most meeting days are lifeless in the morning followed by choppiness after the statement is released. I have noticed that the markets are acting like the rate hikes may be drawing down. Smallcaps and commodities would stand to gain the most from a stop to rate increases and they are outperfoming lately. Smallcaps thrive in low interest rate environments as they tend to borrow money to fund growth. Commodities benefit from a falling dollar and if the fed is done and Japan is starting rate increases, then the dollar will probably weaken some. It will be interesting to see what actually happens. Here are a few charts that are worth watching.

NOIZ has been getting strong support as seen by the long lower shadows and closes near upper range. May be ready to run up here. GG bounced off the 50sma and has made it to a new closing high.

GG bounced off the 50sma and has made it to a new closing high. BOOM has yet to take out the rising trendline resistance but has managed to make consecutive higher pivot lows.

BOOM has yet to take out the rising trendline resistance but has managed to make consecutive higher pivot lows. CMED may complete a double bottom here and just broke the falling trend channel.

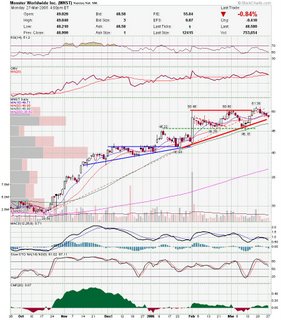

CMED may complete a double bottom here and just broke the falling trend channel. MNST is gently easing to a support trendline.

MNST is gently easing to a support trendline. NICH just cleared some resistance and is close to taking out all the tall wicks.

NICH just cleared some resistance and is close to taking out all the tall wicks.

Thats it for tonight. Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment