One concept shows up in several of the charts tonight. Usually when a stock breaks a resistance trendline, it comes back to test the trendline as support. It doesn't always happen, but I would say it happens more often then not. This is one good reason why it doesn't pay to get anxious and chase up a stock. Also, when you have this opportunity, it usually is the safer entry, because it is near a logical stop loss area. Well, I have lot's of charts tonight, so let's just dive in.

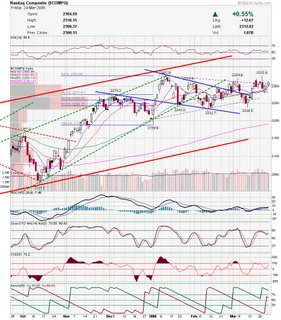

Russell is technically trading a bearish rising flag, but looks like it has penetrated resistance. Nasdaq has been pretty choppy but looks like it has turned back up a little.

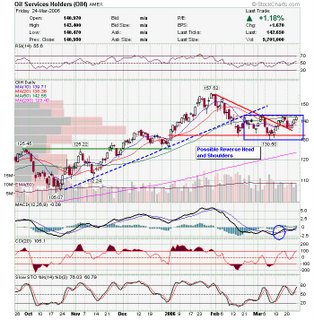

Nasdaq has been pretty choppy but looks like it has turned back up a little. OIH looks like it has formed a little reverse head and shoulders pattern.

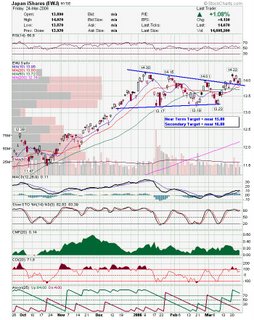

OIH looks like it has formed a little reverse head and shoulders pattern. Japan iShares (EWJ) looks like it has tested support and held.

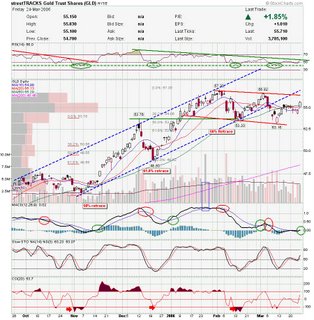

Japan iShares (EWJ) looks like it has tested support and held. Gold and other precious metals have been turning back up. Here is an updated chart on GLD. It would be a bullish breakout if it can clear the upper resistance.

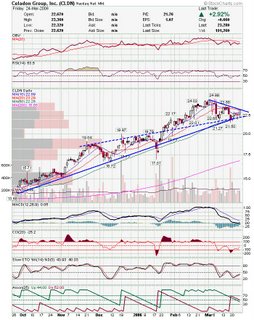

Gold and other precious metals have been turning back up. Here is an updated chart on GLD. It would be a bullish breakout if it can clear the upper resistance. CLDN looks like it is holding support.

CLDN looks like it is holding support. DRQ followed through on the breakout. Usually there is pullback to test support, so I will be watching them.

DRQ followed through on the breakout. Usually there is pullback to test support, so I will be watching them. INFA looks like it will resolve into and ascending triangle.

INFA looks like it will resolve into and ascending triangle. I mentioned NGPS and they had a decent day. This weekend, they were added to IBD100 so there may be some more interest next week.

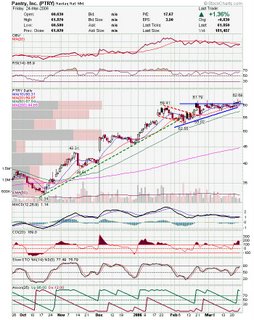

I mentioned NGPS and they had a decent day. This weekend, they were added to IBD100 so there may be some more interest next week. PTRY is above resistance, so it may just be a matter of time here.

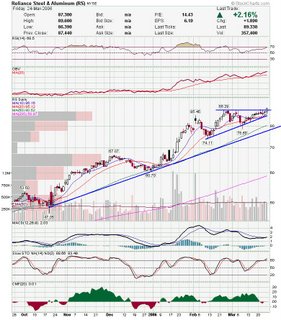

PTRY is above resistance, so it may just be a matter of time here. I am seeing some nice moves in steel stocks and RS is one of them.

I am seeing some nice moves in steel stocks and RS is one of them. SCHK came back to test support and bounced.

SCHK came back to test support and bounced. SCSS may rest a couple days and then turn higher.

SCSS may rest a couple days and then turn higher. TSCO has a little more room to the upside here.

TSCO has a little more room to the upside here. TWGP is another stock that pulled back to test support.

TWGP is another stock that pulled back to test support. USG may be ready to finish testing top of base.

USG may be ready to finish testing top of base. More of the same with WCC testing the breakout area.

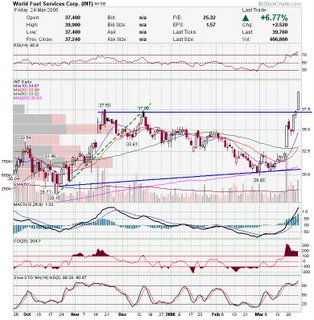

More of the same with WCC testing the breakout area. INT has been really strong and cleared all resistance.

INT has been really strong and cleared all resistance. ENG looks like a lot of the oil service stocks with a little ascending triangle after a pullback.

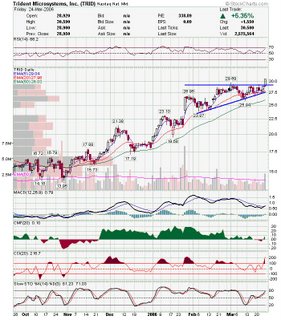

ENG looks like a lot of the oil service stocks with a little ascending triangle after a pullback. TRID had a nice breakout Friday.

TRID had a nice breakout Friday. NTAP is holding above support and networking has been hot lately.

NTAP is holding above support and networking has been hot lately.

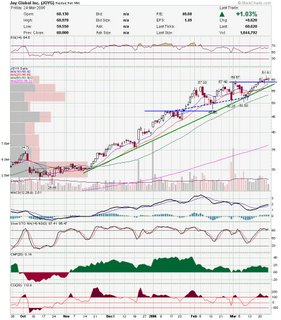

AKS is another steel stock that has been looking good. JOYG is also holding above support.

JOYG is also holding above support. PAAS just cleared resistance and looks the least overbought of the silver stocks.

PAAS just cleared resistance and looks the least overbought of the silver stocks. DBRN is another support retest play.

DBRN is another support retest play. PVH is holding strong not giving up much of the breakout while it consolidates.

PVH is holding strong not giving up much of the breakout while it consolidates. NVDA broke a triangle to get to a new 52 week high.

NVDA broke a triangle to get to a new 52 week high. ALDA is a thin low float stock of a great company. May be a decent buy at bottom of channel, plus I really like their NV shaft.

ALDA is a thin low float stock of a great company. May be a decent buy at bottom of channel, plus I really like their NV shaft. PRLS has fought back from a steep pullback and just hit a new 52 week high.

PRLS has fought back from a steep pullback and just hit a new 52 week high. Last chart is an intersting view of SUF. Here is the weekly chart showing...... you guessed it, a retest of support.

Last chart is an intersting view of SUF. Here is the weekly chart showing...... you guessed it, a retest of support.

I haven't posted any short charts tonight because I already have a nice list to watch in case the markets reverse here. Most of the shorts I have mentioned over the last week are still in play Hope these charts help in your trading. Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment