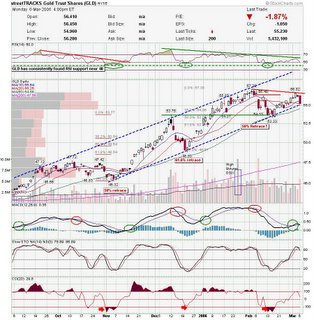

As I posted earlier, the divergence between GLD and gold stocks shouldn't last too long. I was expecting Gold stocks to turn up, and the did for a couple days, and now they all turned down in unison. There is a chance that we have made a near term top in gold, but we have to wait for confirmation. Here is a chart of GLD. GLD is an ETF that trades gold bullion. The gold index chart is similar to this one. It has been trading this channel nicely and bounced recently off the trendlline and 50sma. It started to trend higher before todays sharp pullback. Watch the trendline and 50sma over the next couple of days to see how GLD reacts. GG has been the strongest gold stock. They gapped higher on earnings news, and then pulled back most of the day until a little run in the afternoon.

GG has been the strongest gold stock. They gapped higher on earnings news, and then pulled back most of the day until a little run in the afternoon. NEM broke out of the primary channel, and may get a bounce in the previous channel.

NEM broke out of the primary channel, and may get a bounce in the previous channel. AUY fought back today and closed above support.

AUY fought back today and closed above support. PCU is not a gold stock, but I think it's worth mentioning that most metals trade together. PCU is near a trendline, and if we get a bounce in precious metals. I would expect PCU to follow suit.

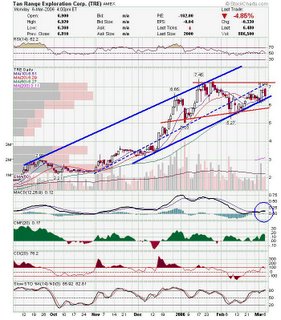

PCU is not a gold stock, but I think it's worth mentioning that most metals trade together. PCU is near a trendline, and if we get a bounce in precious metals. I would expect PCU to follow suit. TRE is has had support on this trendline before and is also trading in an ascending triangle base.

TRE is has had support on this trendline before and is also trading in an ascending triangle base. Be sure to read my posts from last night below.

Be sure to read my posts from last night below.

Good Luck,

DT

Is Gold entering a deeper correction?

Posted by downtowntrader | 3/06/2006 10:39:00 PM | 0 comments »

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment