It is looking like we may get the technical bounce I was expecting tomorrow. Dow eeked out a gain today and SP held 1270. NAS was hammered all day by chip stocks and fell through back in to the wedge. While this is bearish, the hourly chart is pointing to some near term support. However GOOG was down AH and may weigh down on the index. I am looking at mostly longs as shorts are likely to get chopped around. If we have a negative day, I will probably look back to oil sector for some plays.

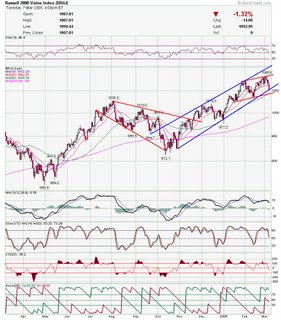

Here is the Russell. Notice it is right at a trendline. If it falls, then look for redline as next support. Here is the nasdaq falling back in to the wedge.

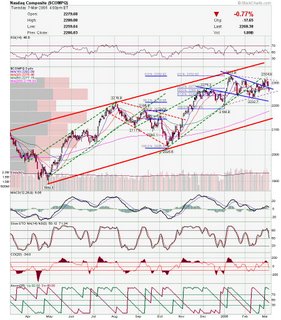

Here is the nasdaq falling back in to the wedge. ISE broke to new highs this afternoon. I was expecting most of the exchanges to do well in sympathy to NYS beginning to trade tomorrow, but all of them save for ISE were beaten down pretty bad.

ISE broke to new highs this afternoon. I was expecting most of the exchanges to do well in sympathy to NYS beginning to trade tomorrow, but all of them save for ISE were beaten down pretty bad. EZPW showed some nice strength the past couple days with markets falling apart and them breaking to new highs.

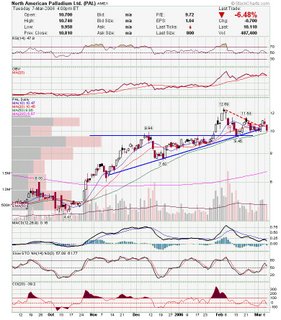

EZPW showed some nice strength the past couple days with markets falling apart and them breaking to new highs. PAL reversed course and is in danger of breaking the 50 SMA. Should make a nice short if metal's keep getting hammered.

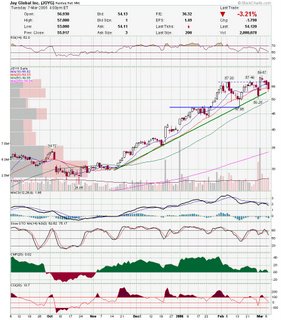

PAL reversed course and is in danger of breaking the 50 SMA. Should make a nice short if metal's keep getting hammered. JOYG has pulled back after strong earnings, and is setting up for a test of the trendline.

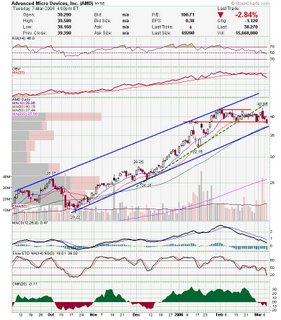

JOYG has pulled back after strong earnings, and is setting up for a test of the trendline. AMD has been acting very weak and looks to be testing the trendline and 50 sma. If markets stage a recovery rally, AMD may get a boost.

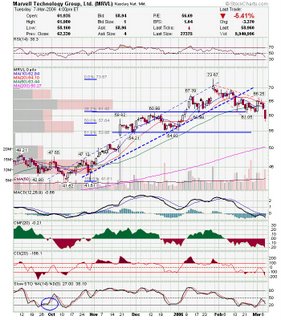

AMD has been acting very weak and looks to be testing the trendline and 50 sma. If markets stage a recovery rally, AMD may get a boost. MRVL broke serious support and was my best daytrade today. If markets bounce, then I will be looking to short it again near the trendline (if it can't hold of course).

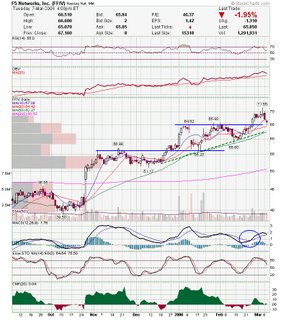

MRVL broke serious support and was my best daytrade today. If markets bounce, then I will be looking to short it again near the trendline (if it can't hold of course). FFIV has pulled back to ttrendline and no serious technical damage has been done here.

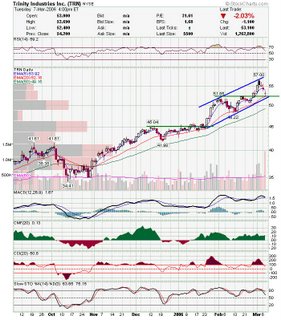

FFIV has pulled back to ttrendline and no serious technical damage has been done here. TRN is setting up for a test of trendline support and had a doji at support.

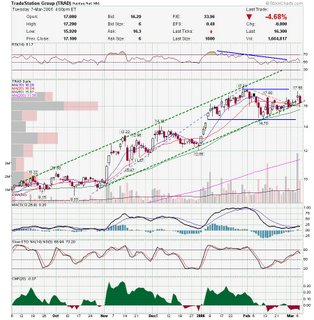

TRN is setting up for a test of trendline support and had a doji at support. TRAD gave back yesterdays gains but has held the trendline. Watch tomorrow's action for a break to either side.

TRAD gave back yesterdays gains but has held the trendline. Watch tomorrow's action for a break to either side.

While I am thinking we get a bounce soon, I don't think it will be the beginning of any sustained move. Trade cautiously.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment