We got a bounce starting around middle of day as expected, although the close left much to be desired. Tomorrow is a key day to see if we get follow through on a recovery rally. At this point it looks like a retracement rally and not the beginnings of anything special.

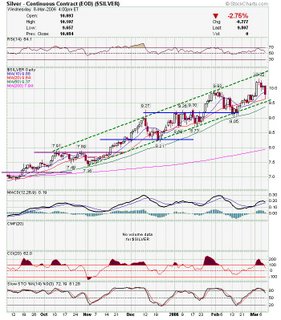

Small caps have been getting hammered lately and Russell finally decided to fight back. Looks like a possible head and shoulders forming if we get a bounce that stops on the red trendline. While Gold looks like it's beginning a deeper correction, Silver is still within the channel. Silver has been stronger for some time now, and while precious metals tend to trade together, Silver is the clear leader.

While Gold looks like it's beginning a deeper correction, Silver is still within the channel. Silver has been stronger for some time now, and while precious metals tend to trade together, Silver is the clear leader. SLW has sold off a little too quick and hit the 50% retracement today. I added to my position this morning.

SLW has sold off a little too quick and hit the 50% retracement today. I added to my position this morning. PAAS is another silver play if we get a bounce.

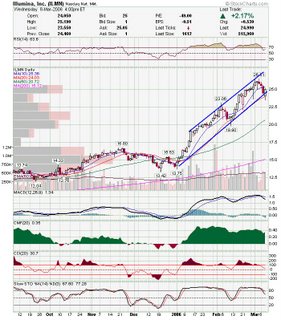

PAAS is another silver play if we get a bounce. Biotechs were strong today and look like they may build on those gains. ILMN has been trading a tight channel.

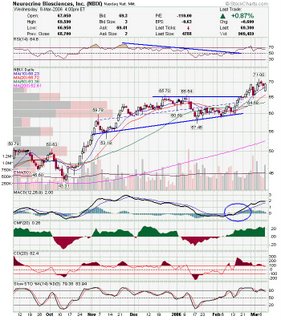

Biotechs were strong today and look like they may build on those gains. ILMN has been trading a tight channel. NBIX chart is self explanatory.

NBIX chart is self explanatory. GILD got a nice lift off the 50sma and trendline support.

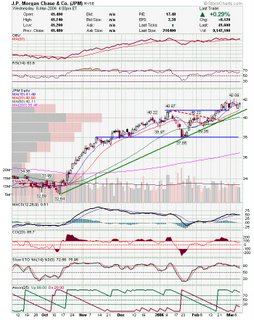

GILD got a nice lift off the 50sma and trendline support. Financials also look ok, and JPM is trying to clear consolidation.

Financials also look ok, and JPM is trying to clear consolidation. AKS pulled back a little but got support.

AKS pulled back a little but got support. The other sector that has looked good is retailers. AEOS cleared a reverse head and shoulders type base and is completing a continuation candle pattern.

The other sector that has looked good is retailers. AEOS cleared a reverse head and shoulders type base and is completing a continuation candle pattern. BBY looks like it is breaking a pennant consolidation.

BBY looks like it is breaking a pennant consolidation. CVS broke through a nice ascending triangle.

CVS broke through a nice ascending triangle.

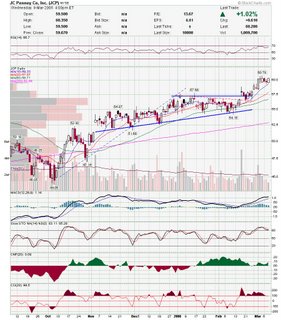

JCP has held it's breakout and has been consolidating very well. BNT may be forming a double bottom here. Keep in mind that buying under the 50sma is risky.

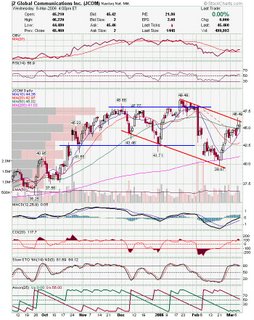

BNT may be forming a double bottom here. Keep in mind that buying under the 50sma is risky. JCOM has climbed back to the top of the trendline. Watch for a move to either side.

JCOM has climbed back to the top of the trendline. Watch for a move to either side. PEIX is testing lower trendline of triangle.

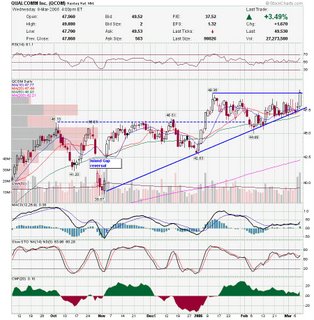

PEIX is testing lower trendline of triangle. QCOM had a nice move on volume today.

QCOM had a nice move on volume today. Good Luck,

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment