All the indices reversed from breakout moves after Nasdaq couldn't follow through. While this may not be the nail in the coffin, it looks like there will be some near term weakness or nervousness. Small caps have been hammered in the past two pullbacks, so I have trimmed back substantially on my swing holdings. It's much easier to jump on a breakout rally then to try and salvage gains in a sharp pullback. Most of my money was made on the short side today, save for a Home Depot long trade and I feel that the easier money may be on the short side the next few days. If still like some longs, specifically in the retail sector. HD cleared resistance today, but closed back in their base. There are some interesting retail charts below that could move nicely if HD or WMT can spark a retail rally.

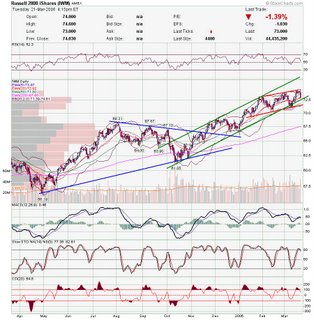

Here is my Russell Index chart. Not much to say that the chart doesn't show. IWM is the ETF if you wish to play the Russell directly. Near mirror image of course.

IWM is the ETF if you wish to play the Russell directly. Near mirror image of course. CMC broke an ascending triangle base on very nice volume.

CMC broke an ascending triangle base on very nice volume. I try to keep an eye on stocks that have been removed from the IBD 100 for breakdowns. This is one that has fallen apart. It looks like FDG has fallen pretty far, but look at the previous pullbacks as examples that there may still be downside here.

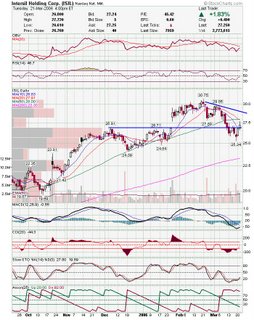

I try to keep an eye on stocks that have been removed from the IBD 100 for breakdowns. This is one that has fallen apart. It looks like FDG has fallen pretty far, but look at the previous pullbacks as examples that there may still be downside here. ISIL is another IBD removal that broke down and is retesting support.

ISIL is another IBD removal that broke down and is retesting support. LVS is slipping under support and the 50 sma. Keep an eye for a breakdown.

LVS is slipping under support and the 50 sma. Keep an eye for a breakdown. RTP has a clearly defined channel here. This should be a swing trade as it is pretty hard to trade $100 plus low float stocks.

RTP has a clearly defined channel here. This should be a swing trade as it is pretty hard to trade $100 plus low float stocks. TRAD looks similar to GROW chart from last night, which worked out as a decent short. Watch for key support here.

TRAD looks similar to GROW chart from last night, which worked out as a decent short. Watch for key support here. Here is the first of the interesting retailers. Very strong move for PVH and closed at high of day in a weak market.

Here is the first of the interesting retailers. Very strong move for PVH and closed at high of day in a weak market. DBRN had a milder breakout, but closed at a new high.

DBRN had a milder breakout, but closed at a new high. TJX is another retailer that broke out of a solid base.

TJX is another retailer that broke out of a solid base.

I still maintain that this environment is better suited for short timeframes.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment