More sideways action today. I've been half expecting the markets to turn down, but there may be a chance that the Nasdaq plays catchup first. Chips are pretty oversold and some tech names are looking downright bullish. CSCO has been leading a networking run, and MSFT and IBM have looked pretty decent. There is also a chance the GOOG may be holding gap support (chart below). As always, I am waiting for the market to tell me which way to go, and I continue to keep ample cash in reserves.

There are also some contruction related charts that are looking good and basic materials continues to act well.

Let's start with HD. They are trading an expanding wedge, and there is a chance that they break it on this test of the upper trendline. FAST broke out of a similar expanding wedge and looks like they are moving higher.

FAST broke out of a similar expanding wedge and looks like they are moving higher. STRL had a nice move today and is currently testing gap resistance. The gap will be resistance until they can close above it.

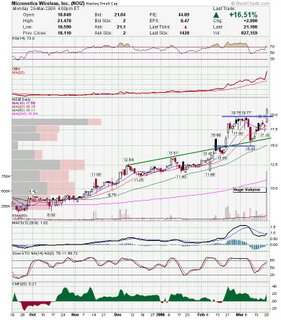

STRL had a nice move today and is currently testing gap resistance. The gap will be resistance until they can close above it. NOIZ had a nice move today on huge volume for them. This is a pretty choppy stock so trade carefully.

NOIZ had a nice move today on huge volume for them. This is a pretty choppy stock so trade carefully. RIO broke down and is testing resistance.

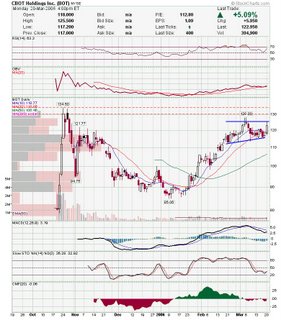

RIO broke down and is testing resistance. BOT is resolving into a deep cup and handle base. Watch for a move over the pivot point.

BOT is resolving into a deep cup and handle base. Watch for a move over the pivot point. ERS is the number 1 stock in the IBD 100 and just broke out of an ascending triangle. They need to clear the previous high and there are indicator divergences, but this chart looks bullish.

ERS is the number 1 stock in the IBD 100 and just broke out of an ascending triangle. They need to clear the previous high and there are indicator divergences, but this chart looks bullish. HITT is clearing a choppy triangle base here.

HITT is clearing a choppy triangle base here. NTES is another volatile stock that just cleared resistance.

NTES is another volatile stock that just cleared resistance. TWGP is yet another choppy base that has broken out.

TWGP is yet another choppy base that has broken out. JOYG has been a very solid stock and just made a new 52 week high today.

JOYG has been a very solid stock and just made a new 52 week high today. GFIG may fall apart here, but keep an eye on it as it may also find support.

GFIG may fall apart here, but keep an eye on it as it may also find support. HELX looks like a decent low risk short opportunity.

HELX looks like a decent low risk short opportunity. GROW is testing major support here.

GROW is testing major support here. TRE looks like it broke support here.

TRE looks like it broke support here. Here is the GOOG chart. Notice the candle patterns confirming gap support and it closed almost on the 200 sma.

Here is the GOOG chart. Notice the candle patterns confirming gap support and it closed almost on the 200 sma. Should be an interesting week. Good Luck,

Should be an interesting week. Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment