Lots of charts tonight. I am seeing opportunities for both longs and shorts, but as I ave been doing, I am keeping my trades on a short leash until I feel comfortable with the market direction.

PWEI coming back for another test of resistance. PEIX could break out of this triangle soon.

PEIX could break out of this triangle soon. QCOM looks very good here.

QCOM looks very good here. MNST hit a new 52 week high and closed above resistance.

MNST hit a new 52 week high and closed above resistance. WMT looks like it has broken the downtrend here. While I don't normally trade big caps, it makes sense to watch a stock that can move the entire sector. I would expect a little pullback off the 200sma and a retest of support.

WMT looks like it has broken the downtrend here. While I don't normally trade big caps, it makes sense to watch a stock that can move the entire sector. I would expect a little pullback off the 200sma and a retest of support. CHE looks like it broke out of the recent channel.

CHE looks like it broke out of the recent channel. PLAY is struggling here and 50 has curved down noticably.

PLAY is struggling here and 50 has curved down noticably. CAT looks pretty healthy.

CAT looks pretty healthy. CRDN looks like it may fail to hold support here. Watch for the break first.

CRDN looks like it may fail to hold support here. Watch for the break first.

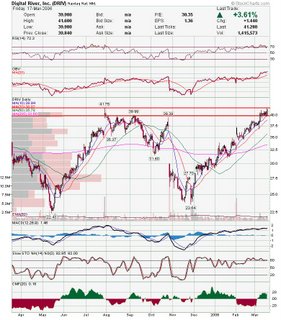

CTRN may trade down this channel. I will be watching DRIV to see if it can take out formidable resistance. Pretty volatile moves on this stock over the past year.

I will be watching DRIV to see if it can take out formidable resistance. Pretty volatile moves on this stock over the past year. EXP may be breaking out here.

EXP may be breaking out here. CCJ is looking a little weak. Keep an eye for a failure at the 50sma.

CCJ is looking a little weak. Keep an eye for a failure at the 50sma.

CLDN is another possible short, although there is a chance it get some support around here. GOL took a pretty good hit on high volume and is struggling. Looks like it will pull back and test support again.

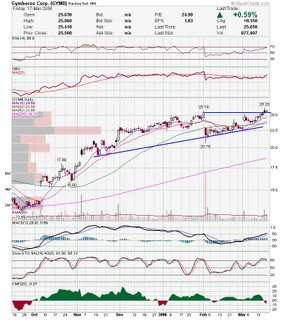

GOL took a pretty good hit on high volume and is struggling. Looks like it will pull back and test support again. GYMB is trying to break out here.

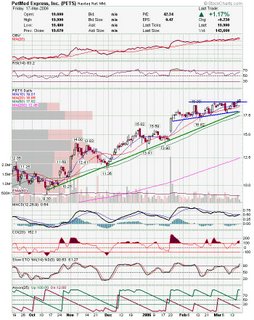

GYMB is trying to break out here. PETS has had a hard time breaking out of this tight range, but may of done it.

PETS has had a hard time breaking out of this tight range, but may of done it. TSU is one I am keeping an eye on for this week.

TSU is one I am keeping an eye on for this week. ARD broke out of the downtrend and then tested support. Looks like it may get a move up here.

ARD broke out of the downtrend and then tested support. Looks like it may get a move up here. DNA had a pretty strong move friday and stopped right at 200. Watch to see if it can break out.

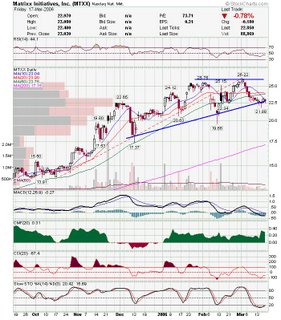

DNA had a pretty strong move friday and stopped right at 200. Watch to see if it can break out. MTXX is trading near the bottom of a triangle here. Watch for a move either way.

MTXX is trading near the bottom of a triangle here. Watch for a move either way. TTI has been holding above it's recent break of consolidation and should be poised to move higher.

TTI has been holding above it's recent break of consolidation and should be poised to move higher.

By the way, I posted a market update earlier tonight (see below).

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment