The major indices got bounces today as expected. Tomorrow will be interesting as lot's of people will be taking the day off ahead of the extended weekend. While a reversal has been in the cards, there has been a lot of chart damage done to all the indices and many stocks. The weekly charts of most of the indices are on sell signals from multiple indicators.

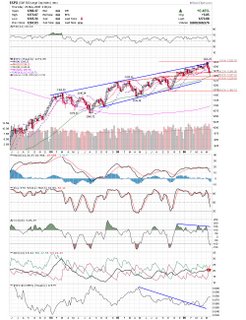

Here is the weekly SP500 chart. It is holding up at the 50% fibonacci retrace which is positive, but parabolic sars is on a sell signal. It is looking like it will retrace up before turning back down. Russell 2000 index printed a morning star reversal pattern today. Lots of damage here, but it looks like it will move a little higher.

Russell 2000 index printed a morning star reversal pattern today. Lots of damage here, but it looks like it will move a little higher. Here is an updated chart of EMCI clearing the downtrend channel.

Here is an updated chart of EMCI clearing the downtrend channel. PCLN is looking pretty good breaking out of a bull flag pattern.

PCLN is looking pretty good breaking out of a bull flag pattern. LIFC looks like it found support at the breakaway gap. Watch to see if it can clear the pennant pattern.

LIFC looks like it found support at the breakaway gap. Watch to see if it can clear the pennant pattern. OII is another bull flag pattern in the works. Looks like it just cleared it today.

OII is another bull flag pattern in the works. Looks like it just cleared it today. PLXS has been pulling back steadily into support. Finally got some buying today and may be ready to retrace some of the pullback.

PLXS has been pulling back steadily into support. Finally got some buying today and may be ready to retrace some of the pullback. PAY is clearing resistance here and may head to top of channel.

PAY is clearing resistance here and may head to top of channel. NTRI may be getting gap support here as well. They still have some resistance to work through but the risk reward is decent here.

NTRI may be getting gap support here as well. They still have some resistance to work through but the risk reward is decent here.

Thats it for tonight. Keep in mind that the indices are trying to hammer out a near term bottom and could give back any gains fairly quickly.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

Good Day,

Could you give a review of SMSI and its Bull Flag TA? Thanks.

Scott K