I've decided to put up my blog for sale. If a site full of videos of star wars re-enactments by chubby kids and monkeys sniffing their ass is worth 1.6 billion dollars, then my hard work has to be worth something right. Maybe I should put it up on Ebay? Seriously though, I can see where some of the major players will eventually try and scoop up some bloggers and their loyal readers in an effort to have fresh and exclusive content.

Today was a fairly indecisive day and with the markets in need of a breather, I think the best move will be to take a few days off. I am posting a few charts below in case the markets move more then I expect though.

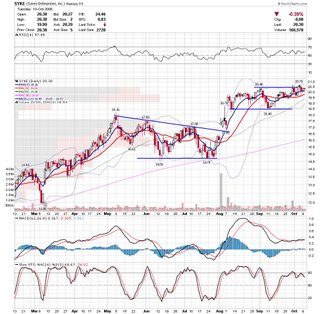

Sykes Enterprises, Incorporated (Public, NASDAQ:SYKE)

SYKE has been holding under resistance and with the 20sma catching up to price, it should be moving soon. This pattern looks more like a continuation pattern, so the move should be to the upside.

Goldcorp Inc. (USA)(Public, NYSE:GG)

GG continues to look like a near term bottoming process is underway. Today was another rejection of prices in the 20-21 range.

Ceradyne, Inc. (Public, NASDAQ:CRDN)

CRDN is a great example of a stock under distribution. Every rally is sold and it looks like it may be turning back down.

America Movil S.A. de C.V (ADR)(Public, NYSE:AMX)

AMX has taken this wedge to its apex. It will be out of room soon, so a move should be in order. I would be more interested in a breakdown at this point.

SINA Corporation (USA) (Public, NASDAQ:SINA)

SINA was one of the charts I liked most from Sundays post, and it is moving along nicely. Keep an eye on the upper pennant line for a breakout. Muaad wrote in on how I review sectors and I thought it would be best to post my response.

Muaad wrote in on how I review sectors and I thought it would be best to post my response.

"I have reviewed the list on StockChart.com's "Market Summary," and I find it a great place to start, but I am aware that there are many Indices and ETFs missing from this list. Can you point me to a definite source that has the most inclusive list of Sector Indices and ETFs? And perhaps the list you track and feel is of importance?"

Before I answer, I will mention that I study the market sectors each weekend to try and determine where to look for a move in the coming week. I also am a proponent of intermarket analysis, so I am keeping a close eye on ratio's and how a specific sector will impact others.

I feel that the indices and ETF's under stockcharts "Market Summary" page is sufficient for what I'm looking for. I only trade a few ETF's such as IWM and QQQQ. The only other ETF's I watch are from www.holders.com, such as SMH and RTH. If you are looking for Industries and Sub Industry rankings then www.investors.com is the place to go, but it is not free. They rank over 100 industries I believe. If you are looking for ETF's then the yahoo etf page is a good place to look. The whole sector review thing is something that I am still trying to optimize for my trading, but for now, I have found that looking at the general sectors has been sufficient. If anyone has any thoughts on this subject, feel free to post in the comments section.

Good Luck,

DT

Subscribe to:

Post Comments (Atom)

DT,

For years I used TC2005 mainly for data and Metastock for serious TA, explorations, and system testing, but for the past couple years I've used TC2005 simply for the ranking and watchlists features. It is so much more functional for this. Now I probably spend more time on TC2005 than MS. They also have component watchlists of many ETFS.

-MT

Thanks MT. I am gonna check out TC. I have been putting it off because I haven't had the time or desire to tackle new software, but I am curious as to how the new snap sheets thing works. Have you messed around with that piece yet?

DT

OK, TC has a pretty limited learning curve, unless you want to start creating complicated scans, etc. As a charting tool and an organization tool it is excellent. Say, if you have several chart templates you like to look at (different timeframes, different indicators, etc) you can just assign them to separate "F" keys and quickly switch through them and just hit the spacebar to tool through the stocks in a watchlist or scan. The ability to rank according to preset criteria is great also. Overall it is not difficult software to learn. My first try at Snap sheets on the other hand was a little overwhelming. Overall, the concept is great but talk about taking something simple and making it complicated....geesh! If I cant click on an object and change the color in less than 2 clicks then forget it. With snap sheets you have to create a flow chart for everything. I work in electronics, I look at schematics several times a week, I just don't think its a good idea for a charting program. IMHO, the best charting programs are "object" oriented, like metastock and (less so) TC. Hope this helps.

-MT

Thanks MT, that was helpful. I will probably try it out soon.

DT