The markets are seriously overbought on all timeframes and probably pretty near to a pullback of some sort. I wouldn't get too aggresive shorting, because this doesn't look like a topping pattern yet. We may not even pull back yet, but I can't imagine a huge amount of room to the upside here without some rest. Ike Iossif was predicting some softness late this week with strength into options expiration next week. That pattern appears plausible with the current state of the charts.

Here are a couple long term charts to chew on.

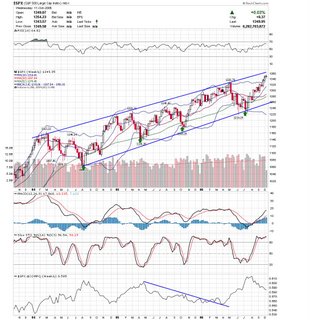

SP500 is near the upper end of this long term channel . It has made a beeline from the lower part of the channel, so there is no way this is shattering the top of this. We can still ride the band for a bit, but we are back to a point where the risk may be greater then the reward. Here is a chart of the weekly nasdaq composite. A couple of interesting points. RSI readings over 70 and near 30 have been fairly reliable indicators of turning points, other then the high 1/06 reading. RSI still has plenty of room here, but this recent leg up still resembles a bear flag.

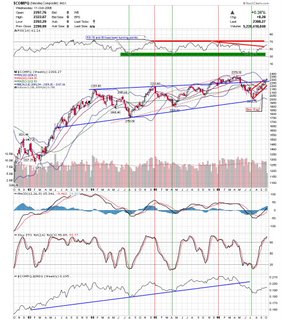

Here is a chart of the weekly nasdaq composite. A couple of interesting points. RSI readings over 70 and near 30 have been fairly reliable indicators of turning points, other then the high 1/06 reading. RSI still has plenty of room here, but this recent leg up still resembles a bear flag. There is still some strength in the markets as bad news today couldn't "stick" and the indices closed off their lows, but my guess is that we still have some indesicive trading range days ahead this week. Here are a few links:

There is still some strength in the markets as bad news today couldn't "stick" and the indices closed off their lows, but my guess is that we still have some indesicive trading range days ahead this week. Here are a few links:

- I uploaded another masterpiece to Downtownart

- Link on Trader Mike by Michelle on CNBC and news factor. Another nice entry by Michelle who has been publishing grade A stuff so far. I would like to add that I prefer to stay away from boards and rarely look at news until after I make my trading decision. I have my own weaknesses and strengths and have realized I do much better in my little vacuum.

- Here is a Link on Trader Gav on writing a business plan. I have another link that I need to dig up that has a comprehensive trading plan template. I'll try and get it out tomorrow.

- On that note, Traderfeed had a nice post on whether you would hire yourself to manage your money.

Good Luck,

DT

Regarding trading plans and MM, I'd like to add to your list of Blogs. www.TAToday.com is a great site to observe this in action as this guy is the only blogger on the web that I know of that actually posts his portfolio spreadsheet on a daily basis. (I think his "public" portfolio is actually his share of a larger managed portfolio.) He's been struggling lately but his long term record is good. You can really get a good sense of the psychology of a trader as well as how one manages market risk on that site. Anyway, lots of good stuff there plus an online book.