This week is options expiration week, and should be interesting with the markets as extended as they are. Although it's probably a little late to be buying this rally too agressively, there is no topping pattern present yet, so I'm not going crazy looking for shorts either. Here are a few charts I will be watching this week.

Citrix Systems, Inc. (Public, NASDAQ:CTXS)

CTXS is one of the few charts I've seen that is near value and not too extended for an entry.

RELM Wireless Corporation (Public, AMEX:RWC)

RWC has pulled back after breaking the downtrend. It may firm up here finding support at the breakout candle.

Sykes Enterprises, Incorporated (Public, NASDAQ:SYKE)

SYKE continues to trade a very tight range near a breakout area.

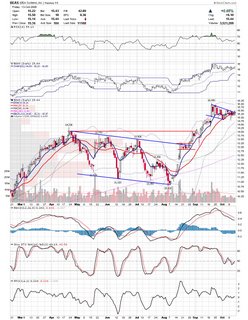

BEA Systems, Inc. (Public, NASDAQ:BEAS)

BEAS looks like it is clearing the bull flag consolidation pattern here.

Piper Jaffray Companies (Public, NYSE:PJC)

PJC is near clearing a much sloppier bull flag then the BEAS flag. It still offers a decent risk reward though with the narrow range candles.

Corrections Corp. of America (Public, NYSE:CXW)

CXW had a huge gap over resistance and has now pulled back on declining volume to gap support.

Google Inc. (Public, NASDAQ:GOOG)

GOOG cleared a triangle and is consolidating the move. It formed one of those NR7's that Tradermike loves and should be close to making a move.

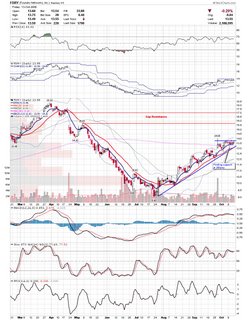

Foundry Networks, Inc. (Public, NASDAQ:FDRY)

FDRY is hugging the 200sma as support and may make a frantic push towards gap resistance. It is looking quite extended on the weekly chart, but sometimes stocks have a way of running longer then anyone expects.

Akamai Technologies, Inc. (Public, NASDAQ:AKAM)

AKAM is making the first trip to the 20sma since it's breakout. This is usually a decent entry for those that missed the party. It looks like it may need a little more consolidation, but could move early if markets get another strong push.

As the indices keep pushing higher, it is important to keep things in perspective as to where we stand in the large picture. The indices are overbought, at the tail end of a 4 year bull market, in one of the most treacherous months for bulls. While it's best to trade reality and not expectations, the fact remains that this is a dangerous time to be fully leveraged. Keep your stops in place, because the dips won't be bought one of these times.

Good Luck,

DT

Options Expiration Week

Posted by downtowntrader | 10/15/2006 10:42:00 PM | akam, beas, ctxs, cxw, fdry, goog, pjc, rwc, syke | 0 comments »

Subscribe to:

Post Comments (Atom)

0 comments

Post a Comment