I'd like to take the time to wish everyone out there a Happy Holiday Season. Hopefully the year treated you well, and if not, keep in mind that everyday is a new opportunity to start over in any aspect of your life.

Regular posting will resume after the New Year.

Happy Holidays,

Joey

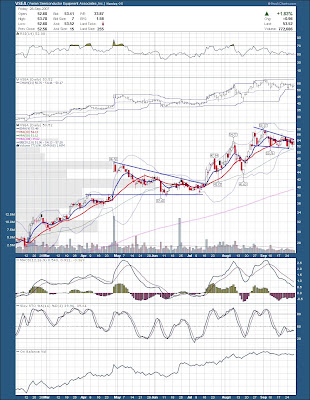

Stock Chart Analysis LOGI

Logitech International SA (USA) (Public, NASDAQ:LOGI)

LOGI has been consolidating bullishly for the past two months after a huge breakaway gap. The breakaway gap followed a year long consolidation and it looks like this gap may not get filled. LOGI is just starting to turn higher off the 20 day sma and it may be ready to breakout to new highs. Breaking the trend line marking the most recent pivot highs would be the first objective on it's way to the breakout. Stochastics is also starting to turn up as well.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis GEOY

GeoEye Inc. (Public, NASDAQ:GEOY)

GEOY had a high volume breakout in October and has rose steadily for almost two months. It has pulled back to it's rising 50 day sma. The bollinger bands are contracting as the stock becomes oversold, which could be a recipe for an upcoming impulsive move up. If the markets show some strength the next few days, then GEOY could have enough strength to clear the downtrend line shown and then test the recent highs over 34.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis BNT

Bentley Pharmaceuticals, Inc. (Public, NYSE:BNT)

I'm gonna mix things up a bit tonight and show a weekly chart instead of a daily one. While I look at weekly charts of every stock I watch, I rarely post them. My success rate is much better when the weekly and daily charts line up with a trade signal. In this case, BNT looks pretty good on the daily chart closing positively in a weak market today, and holding above it's 20 and 50 day moving averages. It looks close to making new 52 week highs, and the weekly chart shows that it may of already cleared a reverse head and shoulder bottom. The right shoulder is not perfect, but it does show a clear picture of bulls rejecting single digit prices. I think the volume pattern is a little weak here, but the price action looks positive. There is a decent chance that if BNT gets over 14, it may follow suit and test it's two year high in the low 20's.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis HOLX

Hologic, Inc. (Public, NASDAQ:HOLX)

HOLX held up pretty well in a weak day Friday. It just hit new all time highs a few weeks ago and the subsequent pullback has been rather tame. It looks like it's in a well defined trading range and it's worth watching to see if it can break through the range soon. If the markets show strength in the next day or two, it may even be worth entering a little early if it can clear $66. A successful breakout would have an estimated target of $77. Of course, the general markets will probably have to cooperate.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis RIMM

Research In Motion Limited (USA) (Public, NASDAQ:RIMM)

Here is another of this years hot momentum stocks coming off a correction. While I'm not banking on RIMM heading to new highs, I wouldn't rule it out either. What is pretty clear to me is that RIMM is coming off the bottom trading range resembling a falling wedge. These can be bullish continuation patterns, but regardless of the ultimate success of failure of the overall pattern, it looks like it will at least attempt a move to the upper boundaries of the wedge. I mentioned in my DRYS post below, that this is also window dressing season, which I think helps a name like RIMM. Window Dressing is when funds pick up a stock that performed well during the year in order for it to show up in the end of the year holding report. This way they can show their investors how they hold leading stocks in their portfolio. Here is some more information on "window dressing". RIMM looks like it may fill that breakdown gap in the 110-114 area, which may also coincide with the descending trendline in a few days.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis DRYS

DryShips Inc. (Public, NASDAQ:DRYS)

DRYS has been one of this years best performing stocks, with a bottom to top run of over 110 points. It has recently been in a correction, along with other dry shipping stocks. While it's too early to say if the stock completed it's correction, it is looking like it's ready to test the waters up above. It had a nice bounce off the 70 dollar mark up near $100, and then settled down nicely on it's 20 day sma. A higher high tomorrow may provide a nice entry with a target near $120. Of course nothing is set in stone as this is a game of probabilities, but with year end window dressing season upon us, and one of the years hottest stocks coming off a correction, I like the chances for this moving higher.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

I'm feeling a little under the weather, so no charts tonight. The markets reversed course today and there are a few different scenarios that could play out. This really could just be a normal pullback off a rally high, or it could turn into a lower high which could then begin a primary bear market. The way I'm playing it is to honor my stops in my existing holdings that are acting well, while nibbling on the short side / inverse funds. A few short candidates I am looking at are JNY, RUTH, MRO, CAM, and YRCW. On the inverse fund side, I like DUG and possibly FXP.

Good Trading,

Joey

Stock Chart Analysis MCRS

MICROS Systems, Inc. (Public, NASDAQ:MCRS)

While I'm thinking the markets will have a pullback over the next few sessions, I am still bullish overall. MCRS is a stock that I can possibly buy in a couple different scenarios. If the market strength continues, then I can play MCRS as a triangle breakout with the recent bounce off the 20 day sma as a possible stop loss area. If the markets are weak, then I may look to buy MCRS towards the bottom of the triangle, since the odds are that this will prove to be a continuation base. If the second scenario presents itself, I would still look for it to turn back up before buying. In either scenario, the end result is to looks for the stock to eventually clear the current base and move towards $80.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis URRE

Uranium Resources, Inc. (Public, NASDAQ:URRE)

Metals reversed off their lows this morning and had a very strong session at an important area in their charts. While I'm a little nervous about the general markets after their quick rebounds over the past week, metals look like they are just starting to resume their uptrends. URRE is a chart that is looking pretty decent with it just a couple of points from all time highs. It recently cleared a large base and has come back to retest the breakout area. If it holds this area then a reasonable target is near 18-19.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis CDS

China Direct Inc. (Public, AMEX:CDS)

I commented on the other blog last night that I've been seeing some money flow back to the China sector and today there were some large moves in several names. It's tough to find good risk vs reward setups coming out of sound bases in this sector, but I think CDS may fit the bill. CDS is one of the few lower priced China stocks that didn't retrace their full breakouts. In fact, it has held an orderly channel that looks like a large bull flag. It looks to me like it just cleared the consolidation base and if it behaves like a pennant breakout, then the target takes it to 18. Also, while this is not a high volume stock, the trading volume is enough that slippage shouldn't be a huge issue.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis PAAS

Pan American Silver Corp. (USA) (Public, NASDAQ:PAAS)

The gold bugs index ($HUI) had a break out on the weekly chart in September with several mining stocks hitting multi year highs along with it. Most have been under pressure recently and are in an area where a pullback may be complete. PAAS for instance surged in late October and early November and has since retraced about a third of the rally from top to bottom. It is now oversold and sitting near the previous breakout area which could provide support. Fridays low may end up holding for quite some time.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis OMCL

Omnicell, Inc. (Public, NASDAQ:OMCL)

OMCL recently broke out to all time highs, but ended up retracing the whole breakout. While this is not normally a bullish sign, the fact is that it did end up holding support and it has been forming a base over previous resistance. The small base it has been working on looks like a reverse head and shoulders with a projected target over 30 if successful. It looks like a close over 27 would seal the deal so I am watching to see how it handles the 50 day sma as resistance.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis OSIP

OSI Pharmaceuticals, Inc. (Public, NASDAQ:OSIP)

Finding a bullish chart in the recent mess we call the markets recently, is much like finding an oasis in the middle of the desert. OSIP stuck out like a sore thumb tonight as I was wading through one bearish engulfing pattern after another. OSIP looks like it is trying to break out of a bull flag consolidation which is no small feat on a day like today. OSIP may also benefit from some publicity with Lazard and Piper Jaffrey hosting Health Conferences the next two days and an Analyst day following on Thursday. Keep an eye on the $40 level as a floor.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis CAM

Cameron International Corporation (Public, NYSE:CAM)

While I'm not bearish on the markets right now, I do think oil stocks are looking like they may slide some more. The XLE and OIH etf's are looking weak and many individual stocks are up against declining 20 day sma's. I'm showing CAM below, but many stocks have similar patterns so as the sector goes, so will this. CAM has moved sharply the past few days from a breakdown low of 85.51 to an intraday high today at 96.51. It then failed at the declining 50 day sma and ended up forming a shooting star candle. This can mark a reversal depending on how the type of follow through it gets the next day or two. The 20 day sma also just crossed under the 50 day sma which is another negative bearish signal I use. All in all this looks like a decent shorting opportunity if it can start making lower daily lows here.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis NST

NSTAR (Public, NYSE:NST)

As I was going through the utility sector this weekend, I noticed a nice cup and handle forming in NST. The Cup with Handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It was developed by William O'Neil and introduced in his book, How to Make Money in Stocks. This is a book I like by the way and usually recommend as a good book for those just getting started in trading.

If you dig a little deeper, you can see a couple of other smaller patterns that helped construct the larger pattern. There was a reverse head and shoulder that formed the bottom of the cup. The breakout has been followed by a sideways consolidation that could be considered a "handle". If it does indeed clear the handle then the target measures out to near $40. Not a wild mover, but there is little risk here as well.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

I started my holidays early today, so there will be no commentary. I will resume posting this weekend. Have a Happy and Safe Thanksgiving.

Joey

Stock Chart Analysis COST

Costco Wholesale Corporation (Public, NASDAQ:COST)

COST has been in the process of consolidating an early October breakout and has weathered the recent pullback without too much chart damage. It is actually pretty close to all time highs, and with the holiday season upon us, it may get the shot in the arm it needs to breakout. The other thing I like here is the fact that the stop loss area is pretty easy to define, with 65-63 being the number based on your trading style. If the markets get a Santa Claus rally, then I feel COST will easily make new highs,

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis GLNG

Golar LNG Limited (USA) (Public, NASDAQ:GLNG)

GLNG has been trading a in a repeating series of high volume breakouts followed by lower volume consolidation patterns. This is of course healthy and fairly typical in sustainable trends. I've been keeping an eye on GLNG because as the markets were taking a beating and dry shippers were being taken out to the woodshed, GLNG refused to budge. While technically GLNG is in a different shipping sector from the dry bulks, I would of expected some of the weakness to spill over. It didn't and GLNG has been patiently hanging out near it's all time highs. It looks like GLNG is attempting to breakout of it's recent consolidation base and with that move it's possible that it will break out to new all time highs.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis SNHY

Sun Hydraulics Corporation (Public, NASDAQ:SNHY)

SNHY had an incredible run from early this year through it's peak in July. It then had a pretty swift and steep correction, before leveling off into a W bottom. It then tested the previous highs and has since been in a consolidation range between the W bottom and yearly high. It looks like there is a chance that it will set a low here at the previous W breakout area and head back up to challenge for a breakout. The worst case scenario is a stop out for a small loss, but with a little luck and a decent rally in the markets, SNHY could ultimately breakout to new highs.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis VMW

VMware, Inc. (Public, NYSE:VMW)

The Case for VMW

VMW has been hit hard the past few days and while it rarely pays to catch a falling knife, there's nothing wrong with picking it up off the floor after it's been dropped. I won't wax poetic about their product in this post, although being in the IT industry, I see everyday how they are dominating their niche market. What I will talk about are some technicals and possible market psychology trends that could influence VMW.

VMW has been one of the best performers this year opening well above it's $29 IPO price and closing at $51. It then moved in a very steady trend peaking at $125.25 just 56 sessions later. It has had a very steep pullback dropping almost 50 points in just 7 sessions. It has pulled back into it's 50% Fibonacci retrace and prior consolidation area. While it's still in a freefall, this is an area that "should" hold if all is well with the company. And while it may not bounce up in a straight line, it makes sense to start watching it, because there are a few seasonal trends that may influence them. First, a lot of traders missed VMW, and have been waiting for a pullback to get in, and this is the first time VMW has made the trip to it's 50 day sma.

Second, we are starting to approach a seasonally bullish period for stocks and then there is the year end window dressing period. Window dressing is when fund managers pick up the hot stocks of the year late in the year so they can report them as holdings in their annual reports, while simultaneously dumping laggards they prefer to not brag about. I can't think of too many stocks that would be more attractive for this type of trend then VMW. So again, it's probably early, but I would be shocked if VMW wasn't back over $100 by the end of the year.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis FCSX

FCStone Group, Inc. (Public, NASDAQ:FCSX)

FCSX recently cleared a reverse head and shoulders pattern that is a smaller part of a larger consolidation base. The target of the H&S take FCSX out of the triangle, possibly signaling a true breakout to new all time highs. Drilling down to the near term shows that FCSX is still vulnerable here as it remains under the 20 day sma. However, it did find support at the 50 day sma and lower bollinger band, so there is a chance that it could resume the breakout here.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis CSUN

China Sunergy Co., Ltd. (ADR) (Public, NASDAQ:CSUN)

Solar stocks have been on fire recently and chinese stocks caught a little buying this afternoon as well. CSUN happens to belong to both sectors and looks like it may be close to completing a consolidation after breaking out of a trading range. It looks like it may be in the process of setting higher highs and lows, which means 8.57 should hold as a low as it challenges for new highs. Of course a sustained move below 8.57 would negate the trade.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis FCN

FTI Consulting, Inc. (Public, NYSE:FCN)

FCN is quickly approaching a critical juncture as it struggles to maintain its October breakout. It has pulled back to the breakout area for a second time and quickly caught a bid as it tested the lower $50's. I think there are some clear lines drawn in the sand here and if FCN can turn around and reclaim $54-55 then I think a breakout will follow soon thereafter.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Both stocks (ACAD and NGS) I was gonna post an analysis on tonight report earnings the next two days, therefore are automatically disqualified from my watchlist. I will resume posting charts tomorrow.

Good Trading,

Joey

Stock Chart Analysis JRJC

China Finance Online Co. (ADR) (Public, NASDAQ:JRJC)

JRJC has held up pretty well this morning and looks like it wants to test a break out. Buyers have been stepping up on most pullbacks and overall this is a very good looking chart structure. The first step would be a close over the 20sma, followed by a move over the trendline showing the top of the base.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis DWSN

Dawson Geophysical Company (Public, NASDAQ:DWSN)

DWSN has been a very solid performer over the past year, and they recently stepped it up with a strong move from August through September. The move was sparked off by a high volume gap and it's never come close to filling the gap. It is in the process of consolidating, forming a triangle that looks pretty orderly. As I've mentioned in the past these are usually continuation patterns and DWSN is in a spot where a low risk entry can be had. Any move over 83 will probably lead to new highs.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis GWW

W.W. Grainger, Inc. (Public, NYSE:GWW)

GWW is looking like it has some more room to the downside here. It failed to match it's previous high and then dropped on increased volume. It cleared an established channel to the downside in the process and could be headed all the way down to the bottom of a larger possible consolidation pattern. If the markets react negatively to whatever the Fed has to say, then I think GWW is a pretty decent short setup.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis CTEL

City Telecom (H.K.) Limited (ADR) (Public, NASDAQ:CTEL)

While the media continues to talk about the "bubble" in China, the underlying stocks keep moving higher. Recently, there has been some profit taking in the sector in general, but there are stocks making large moves everyday. Take a look at EFUT and HMSY today, and YTEC and HMIN last week. I'm not too worried about a bubble bursting when everyone is watching for it. A bubble only bursts when everyone is positive about it and buys in. Here is a chart of CTEL which recently had a huge move almost tripling from low to high. It has been pulling back on decreasing volume and is starting to turn back up on the 20sma. This could easily double from here on a retest of the high, although it would more then likely resolve into some form of a triangle before breaking out. Either way, there is a good chance that the recent low will hold for a rally attempt.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis JRJC

China Finance Online Co. (ADR) (Public, NASDAQ:JRJC)

Chinese stocks have had a chance to take a breather over the last week, but it seemed like some started to perk up today. YTEC, EDU, CPSL, and CHDX had some buying and other reversed off their lows. JRJC is one of those that started a little weak falling a point and a half from the open, but found a floor and moved over 4.5 points from the low. It backed off the highs but was trading back near 40 in the AH market. Overall JRJC is sporting one of the better looking charts in the "China" sector and it has healthy volume. It has had a huge runup, but is consolidating in a bull flag pattern which can result in powerful breakouts equal to the trend that preceded the consolidation. JRJC may of given a buy signal today, but with Asian markets weaker overnight, it could give another opportunity with a lower open in the morning provided it holds reasonable support. Other China stocks that may be in a decent spot are CDS, CHNR, RCH and maybe CTEL depending on how it develops intraday.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis DISH

EchoStar Communications (Public, NASDAQ:DISH)

DISH broke to multiyear highs in April before succumbing to market weakness. After a healthy consolidation they raced towards new highs once again a few weeks ago. They have been trading sideways for a few sessions now, and it looks like demand is simply overwhelming supply in this stock. I wouldn't be surprised if DISH was headed towards it's all time high in the 80's on longer timeframes. In the near term, I'm looking to see if DISH can close over 50 which should lead to further strength.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

All of the major indices experienced high volume reversal days, which had to expected after the recent runup. After the recent string of steady up days, this mornings gap up was begging to be faded. Also as expected, it was fast and furious. It seems like volatility really is returning to the markets and the VIX had a nice bounce higher near support today.................read more at downtowntrader.com

Good Trading,

Joey

Stock Chart Analysis FCN

FTI Consulting, Inc. (Public, NYSE:FCN)

FCN has been trading a pretty tight sideways range since breaking out in August. This type of pattern can be classified as an ascending triangle and usually resolves itself as a continuation pattern. Closing above 54 would be a step in the right direction.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis LTON

Linktone Ltd. (ADR) (Public, NASDAQ:LTON)

LTON had a nice surge a few days ago and has been consolidating that move since then. Chinese stocks have been on fire and while this is not a Chinese company, they provide services to China. Either way, I could care less what the driver is as long as someone is buying it. As a technical analyst, it is my job to uncover situations where one group of traders is overwhelming the other. LTON is a good example where bulls may be about to overrun bears.

Here is the daily chart showing a possible pennant forming above the 200 day sma.

The weekly chart is also promising showing LTON trading up near the high end of an established trading range. This is a level I will be watching as a break could mean the beginning of a new trend higher.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis VSEC

VSE Corporation (Public, NASDAQ:VSEC)

Continuing the theme of low volume small caps, I present an intriguing chart of VSEC. I think I may be early on this one, but since it's holding the 20sma and has a clear stop area defined, I feel it's worth watching. If if fails, the losses should be minimal, and if it succeeds, then it should at least test the previous high near 57. Taking small risks for large gains is the name of the game. VSEC may be trading in a large triangle, which is why I feel I may be early (assuming a pullback to the bottom of the triangle before a breakout), but it may just as well already be in a new leg up. It had a pretty quick correction in August, and has been fairly steady since then. It's already at a point where most people that dumped in August may be regretting it and inclined to repurchase the stock. We should find out soon enough which direction it will take.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis AVNR

AVANIR Pharmaceuticals (Public, NASDAQ:AVNR)

AVNR recently cleared a down trend channel and attempted to breakout. It paused at horizontal resistance and backed it's way to test the trend line again. It's at a point where the true trend should emerge. It will either pull back again and possibly keep drifting back down, or it will surge forward over the $2.50 area. Either scenario is pretty clearly defined, so at a minimum there shouldn't be too much guesswork here.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis BCON

Beacon Power Corp. (Public, NASDAQ:BCON)

BCON may be close to breaking to new highs here. It has been consolidating the past few months and just recently started inching above most of the consolidation area. Volume is starting to pick up and there could be a decent short squeeze if it clears the July high, it could easily make the push to 2005 high over $5.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis ROY

International Royalty Corporation (Public, AMEX:ROY)

ROY is a low volume small cap miner that may be poised to move higher. It was correcting in a channel after almost doubling earlier in the year, and it just recently cleared the channel. It's hugging the 20 day sma now, and could be close to setting a higher pivot high, which would confirm the change of trend from down to at least sideways. Clearing 7 could be the beginning of a move to new highs.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis FCSX

FCStone Group, Inc. (Public, NASDAQ:FCSX)

FCSX has been forming a reverse head and shoulders chart pattern recently and looks like it is just above the neckline, which would validate the pattern as a bottom. It is close enough here that it could go either way. If it does clear the base, then the target takes it to it's all time highs, so it's worth paying attention here.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis AFSI

Amtrust Financial Services, Inc. (Public, NASDAQ:AFSI)

The insurance sector has been perking up lately and AFSI has the potential for being an outperformer if the sector breaks out. AFSI is pretty young, coming up on it 1st year of trading and it looks like it's first correction is about up. It is starting to set higher lows as buyers get more aggressive. It convincingly reclaimed the 50 day sma today and could challenge resistance overhead soon.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis VSEA

Varian Semiconductor (Public, NASDAQ:VSEA)

Semiconductors have been pretty quiet lately, trading sideways while the general markets move higher. There is a chance that semi's may be ready to move higher soon and VSEA should be one of the leaders. It is just under all time highs and has been consolidating in an orderly fashion. I would look for it to successfully clear the $54 area before I got too excited though.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis CRDC

Cardica, Inc. (Public, NASDAQ:CRDC)

CRDC had a huge breakout in the beginning of September moving over 100% in one day. It has been consolidating that move while possibly forming a bull pennant chart pattern. It looks like it may be starting to gain some momentum again and could be headed to new highs. Bull Pennants are the best performing chart pattern according to Thomas Bulkowski who has studied chart patterns exhaustively.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis ESRX

Express Scripts, Inc. (Public, NASDAQ:ESRX)

I was bearish on ESRX a few weeks ago, but it has improved it's posture considerably since then. It completed a 3 wave correction and then followed it up by tagging new highs. It has been consolidating in a bullish fashion for the past trading month and could be close to breaking out. Also appealing on this chart is the clear stop loss area that affords precise risk parameters. This could move out as soon as tomorrow.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis ISRG

Intuitive Surgical, Inc. (Public, NASDAQ:ISRG)

Momentum stocks have been on fire lately with huge moves in RIMM, BIDU, and WYNN. While ISRG has been steady, it hasn't really taken off. However, ISRG is very close to all time highs and could gain some steam if it clears overhead resistance. The chart looks pretty orderly here and with it bouncing off the 20sma it could be ready to go.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis NAVI

NaviSite, Inc. (Public, NASDAQ:NAVI)

NAVI recently had a strong move to break out of a channel it was following as it consolidated a prior breakout. It has been pulling back the past two days drifting along the upper trendline testing it as support. Often when a stock breaks through a trendline that was serving as resistance, it pulls back to it, where the area should now become support. The logic behind this is that people who sold the stock thinking it would fail at resistance feel like they are getting a second chance to get in, and fear missing out on a breakaway move.

Update: As I was finishing this up, I checked and saw that NAVI reported earnings after hours. It was trading a little higher, so it may be in play tomorrow. In this case, I would probably wait till after 10 am for the opening range to be established.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis TASR

TASER International, Inc. (Public, NASDAQ:TASR)

I was on the TASR bandwagon from May through late July as it steadily climbed 100%. It fought through an ABC (three wave) correction from late July through mid August and appears to be ready for a resumption of the prior trend. It is starting to base over the 20 day sma and should begin using it as support. If we project a measured move similar to the wave leading into the correction, we arrive with a ballpark target near 25.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

I will be on a weekend vacation through Monday, so no charts till then.

Good Luck,

Joey

Stock Chart Analysis SLV

iShares Silver Trust (ETF) (Public, AMEX:SLV)

Gold and Silver have had a very sharp move recently, specifically heading into the much anticipated Fed release. While this could just be the beginning of something, it may of gotten ahead of itself in the near term. I'm not sure why there is a disconnect between Gold and Silver, but the GLD etf is at new yearly highs while SLV remains mired under it's 200 day sma. Looking at the chart of Silver below, it is pushing up against a trendline and it's 200 day sma which may prove to be a little much for it in it's extended state. I'm not sure if it will reverse here and retest the recent lows, but it seems like it will at least backoff and retrace to the 20 day sma. There could be some decent shorts in the sector, being that the miners are also overbought. I am looking at PAAS and SSRI as possibilities.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis HMSY

HMS Holdings Corp. (Public, NASDAQ:HMSY)

While the markets are pretty overbought in the near term, there are still some stocks close to safe entries on the long side. I mentioned how HMSY broke out of a nice base a month ago, and while it did move out, it came back for a retest of support the past week or so. While there is a chance that HMSY had a false breakout and may of topped, you still have to favor the underlying trend until it is proven. HMSY is now sitting on it's 20 day sma, after a nice move on Fed Tuesday. It may consolidate a few more days, but I believe there is a good chance that it moves to fresh new highs soon.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Today is the 10th Anniversary of my wedding and as much as I would like to discuss the huge move after the Fed dropped rates, I don't think it would go over too well at home. The only move I made today was buying into BZH whom I had mentioned in earlier posts. I think there could be a massive squeeze in homebuilders, and in fact there could be a bottom on the BZH chart. I will try and post my thoughts on this tomorrow. One thing I will mention, right now a lot of people may be fearing they missed out. Keep in mind that these moves reverse some times and the prudent thing to do is not chase stocks. Stocks like WYNN, BIDU, RIMM and AMZN have had strong moves leading into todays move and buying now will likely have you underwater soon. Look for stocks like ONXX or DRYS who are starting to move after a pullback.

Good Trading,

JoeyWith the Fed meeting coming up on Tuesday, and all the uncertainty, I think it makes sense to not recommend new swing trades until after the reaction. I will not be initiating new positions other then daytrades as well. One group that looks promising for tomorrow (daytrades) are homebuilders. It looks like they may get a short squeeze heading into a fed meeting where a rate cut seems like a foregone conclusion. They may keep running after the decision as well, but who knows at this point. I'm looking at BZH as a possibility here. Also, momentum stocks like AMZN, BIDU, RIMM, WYNN, LVS, etc. have been giving good intraday moves.

Good Trading,

Joey

Stock Chart Analysis HDNG

Hardinge Inc. (Public, NASDAQ:HDNG)

While I'm not advocating going net short right now, I am taking some short positions if the chart setup looks decent. HDNG is one that may be rolling over and could offer a nice drop in quick order. HDNG had a sharp drop after reporting earnings in early August, but then had an equally sharp bounce higher a couple of weeks later. It has been struggling with the area highlighted below recently, and just lost the support of the 50 and 20 day sma's. While I won't ignore the recent strength in this stock, the fact is it could be rolling over and may drop all the way to the trend line near 28. The risk may well be worth the potential reward.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

I had a new article (Multiple Timeframes can Multiply Returns) published on Investopedia.com today. If you're interested, check it out. Comments are always welcome. If you haven’t caught any of my previous articles and are interested, you can find them in my Articles and Interviews section.

Good Trading,

JoeyStock Chart Analysis CPLA

Capella Education Company (Public, NASDAQ:CPLA)

CPLA has barely budged during the few recent weak market days and remains near all time highs. It has pulled back very gently to it's rising 20 day sma and could find support there. There is a decent chance it pulls back further, but I'm keeping an eye on it in case it decides to break out here.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis KCI

Kinetic Concepts, Inc. (Public, NYSE:KCI)

KCI gapped out of a base in late July and has had some volatile swings as it tries to consolidate the break out. If pulled back to the breakout area and is trying to re-establish the prior uptrend. It reclaimed the 20 day sma and appears to be using it for support. It is close to breaking the downtrend line shown below and could break to new highs soon if the markets cooperates.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis ANIK

Anika Therapeutics, Inc. (Public, NASDAQ:ANIK)

ANIK is a very low float trader, but the chart here looks solid enough to possibly risk a trade. I hate trading these sometimes because it's difficult to get out if you have a larger position, so I try to keep the positions fairly small. ANIK, much like most of the stock market corrected pretty steeply the past month. It's come back a decent amount, and is now drifting back to the 20 day sma. Sometimes these little pullbacks are weak longs locking in profits and with good money management, provide great entries. ANIK may break out if it can climb above the descending trend line shown below.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Stock Chart Analysis MVIS

Microvision, Inc. (Public, NASDAQ:MVIS)

I've trade MVIS a few times this year, mostly successfully. Recently, they reported a deal with Motorola and instead of rocketing higher, it steadily sold off giving back all the post news gains. It kept dropping testing prior swing lows. I've been a bystander in this stock the past few months waiting for a low risk opportunity. Recently, it threatened to break down from an established support line, but held up, and then had a move yesterday making it back above the 50 day sma. This could of cemented the bottom here, and paves the way for a retest of the recent highs. At worst, at least now there is a clearly defined stop loss for a swing trade.

The nice thing about this possible trade setup, is that the longer term picture is pretty rosy for MVIS. It's always a good idea to trade with the larger trend, and there is no denying that MVIS has established a new uptrend. It is consistently making higher highs and lows on the weekly chart. It also clearly broke an established down trend line, and formed a confirmed reverse head and shoulders bottom. Volume is in all the right places, and it appears that this is a solid pattern. It's hard to project targets in low priced stocks, because the move from $1-4 is a 200% move yet the measured target is only 3 points from the breakout point. This still yields a conservative $7 target.

Today MVIS offered a pullback off yesterday's strong move, but held at the rising 20 and 50 day smas. This could be a decent low risk / high reward opportunity.

Good Trading,

Joey

for more analysis, check out downtowntrader.com

Disclaimer: I started a small position in MVIS today near the 50 sma. I am highlighting it because I will add to the position if it continues to move out.