I had a really hard time finding any interesting setups this weekend. With the indices up 6 and 7 days in a row, and overbought, I am not really interested in buying too much. With a short week ahead, I tried to look for some shorts, but couldn't find much there either. It looked like specialty retail was weak, but I didn't like any of the individual setups there. Some of the homebuilders are overbought already, but should find some support from traders worried they missed the bottom. All in all it looks like a good time for a vacation. Here are a few of the setups I found worthwhile.

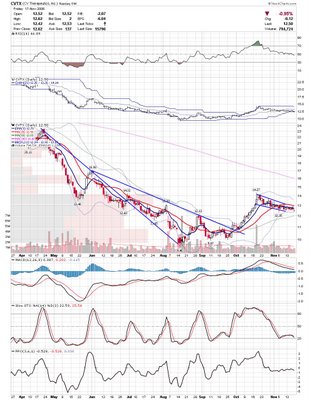

CV Therapeutics, Inc. (Public, NASDAQ:CVTX)

CVTX continues to drift down and consolidate. I am waiting for a high volume day to give the signal that a move is coming.

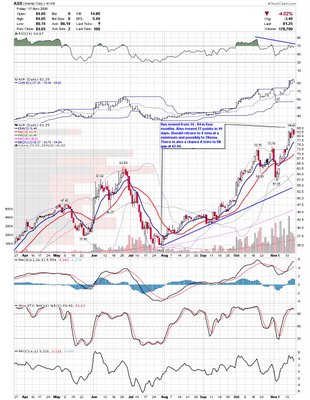

Amgen, Inc. (Public, NASDAQ:AMGN)

AMGN dipped under the current channel and snapped back a bit. Volume increased near the lower channel which may show some accumulation.

AMREP Corporation (Public, NYSE:AXR)

Call me crazy, but it looks like AXR is ripe for profit taking. It has had a huge move over the past four months and is oversold and showing signs of weakness. Look at divergences in indicators, two bearish harami's over the upper band, and in an overbought market.

DXP Enterprises, Inc. (Public, NASDAQ:DXPE)

DXPE is a good example of how I look for previous candle patterns as support. Look at how three previous candles may be giving us a clue that support is coming.

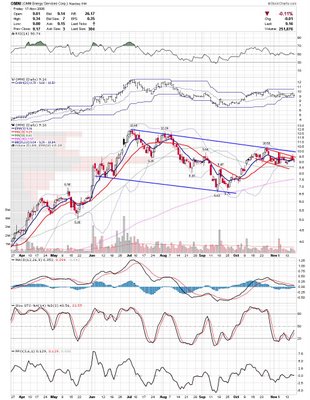

OMNI Energy Services Corp. (Public, NASDAQ:OMNI)

If oil rebounds after the shellacking it got at the end of the week, then OMNI may make a nice move.

I can't remember the last time I had this few stocks on the watchlist, but if ever there was an unclear picture, it is now. While I expect some weakness this week, it probably won't be easy to trade it. Good Luck,

DT

Subscribe to:

Post Comments (Atom)

DT,

If I may add one stock to your watchlist that you may find worthwhile and similar to some of the patterns you look for... I have been tracking NAVR for a few months now, and if you look at the weekly chart it appears to have bottomed and sitting in consolidation for some time. With the way this pattern is working itself out, I feel this is a high probability trade that will likely move into some kind of trend soon if it can break its recent high.

Let me know your thoughts.

Thanks,

Muaad

Muaad,

Thanks for the idea. I checked it out and it looks pretty good. My preferred entry would of been off the hammer 6 days ago, but it is shaping up nicely. I will add it to my stock universe though. This is right on track for the types of setups I have been looking for.

Thanks again,

DT