Whether fairly, or unfairly, trading gets compared to gambling all the time. I think there are more similarities then most traders care to admit, as gambling has been made illegal by hypocritical governments who then sponsor lotteries, while Wall Street is revered as a place where an honest Joe can become rich by investing his hard earned money. Let's look at some similarities:

- Both deal in probabilities and on exploiting a mathematical edge over the long term.

- Both have periods where luck will override statistical probability.

- Both reward a small group while exploiting the masses.

- While odds are fixed in gambling depending on the game being played, and odds vary greatly depending on the market environment, both allow you to manage your betting to when the odds are in your favor.

I was reading through the comments on a great Trader-X post and I found it interesting how one of his readers compared the markets to the "house" and that the more hands you played, the more you would tilt the odds towards the house. I have a different view on who the house is in trading.

I think too many traders think of themselves as trading against the "markets". In reality, for every trade you make, there is another person betting that you are wrong. The exchanges are there to facilitate the trade, you are not trading against them. And although the majority of volume comes from institutions, there are still market makers and specialists who are human that manage each specific trade. So who is the house? In Gambling, the house is the Casino who is exploiting a statistical edge in order to make money in the long run. In trading, the house is the trader who is trading a system with a proven positive expectancy. In both, the house understands that they will experience times of loss, but that in the long run the odds will be in their favor. There are many different "houses" in trading, but you can guarantee that they have the odds in their favor.

So who is the gambler? The gambler is the person who bets without an edge, plain and simple. The gambler will win on enough trades to keep them coming back, but in the long run, the gambler will part with his money whether it's at a Casino or on E-Trade.

Another point was discussed limiting trading frequency. It is an interesting subject because there is a fine line between exploiting your edge, and over trading. In theory, when there is a statistical edge, it should be used as often as possible in order to have the luck factor neutralized. However, in trading, one has to be careful that taking too many setups results in taking mediocre or substandard trades, thereby reducing the expectancy of your system. However, if a system is traded faithfully there really shouldn't be any reason to limit the trades taken unless there are money management reasons for it.

Next time you take a trade, think about who would be on the other side of the trade and why they think you are wrong. Who is the house and who is the gambler?

Not much changed today in the indices as it was a low volume and trendless day. Here are a couple more charts I added to the watchlist.

Cerner Corporation (Public, NASDAQ:CERN)

CERN is coming back to test the breakout area and may bounce off the 20 sma here.

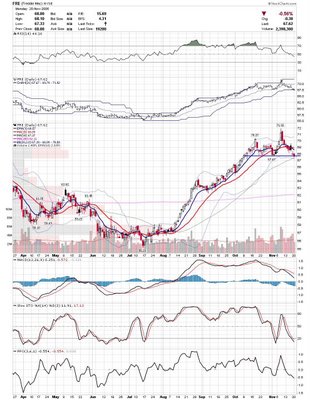

Freddie Mac (Public, NYSE:FRE)

FRE has given back the "Democrats take the house" rally gains but may be getting ready to bounce back higher. It is starting to become short term oversold, yet remains close to the recent highs.

Good Luck,

DT

Interesting comments. I really enjoy your blog and read it every day.

Great stuff!

Thanks dmac. I appreciate it.

DT

Really cool post.

Thanks to you too Estocastica. I really do appreciate when people take the time to comment.

DT

Downtowntrader, Thanks for the insightful post--clear and concise.

Thank you Michelle. I tried to be concise but found myself typing and typing. Glad you liked it.

DT

Good post!

This made me think of those daily busses that haul the retired folks up to the casinos. A friend that works at the local Indian casino noticed that there are fewer and fewer regulars showing up day after day.

"We took all their money," she told me.

I wonder about those folks watching Mad Money everyday or talking to co-workers about hot stock tips and how they faired in 2000 when the bear market came and took all their money away. Is history repeating itself now, as investor confidence rises with every move up in the market?

totally agree with all your points here.

Thanks to everyone for the comments.

Muckdog, you touched upon a classic contrarian indicator. History has shown us that the majority will be most bullish at a top. Look at how low volatility is, as investors have grown so complacent after a 4 year bull market. History will continue to repeat itself, as there will always be gamblers trying to strike it rich.

DT

i just read your interview , very impressive , i learn every day something on your blog .

hope you will keep it that way

thank you for your effort

thierry

Thanks Thierry. If you ever have a topic that you would like me to discuss, feel free to let me know.

DT