These are four stocks showing strength today that are under $10. CMT and PRLS are on IBD's top stocks under $10 list. I've been waiting on BCON for some time now, and this may be the beginning of an alternative energy run. Look at SPIR, DSTI, SPWR, etc. today. MMUS has been consolidating a previous large move, and looks very interesting.

Disclaimer: I own all of these.

I heard that some people are having problems zooming in on my charts. I use Firefox and don't have any issues. I tested with IE and it works if you hover your mouse towards the lower right hand side and click on the enlarge button that pops up. There is an example below. Let me know if anyone still has issues by posting a comment. Thanks,

DT

Dow broke 11 thousand today and everything seems peachy. This usually means it's time to take a little off the table. We had a little warning today as I think the smart money is anxious to take a little off the table. But there is also the chance there is a lot of anxious money on the sidelines that was waiting for the break of resistance. Either way, caution is prudent. The first few charts highlighted tonight are stocks that I am targeting if and when the market pulls back. I will not buy right now as they are all extended from decent entry points.

KOMG: Broke a cup and handle and is near pivot point, but I think it's best to wait on this one as market is extended and this move looks like it needs a little consolidation. JOYG: I sold all my shares already and will wait for the pullback. Volume looks good but there are index funds that are required to add JOYG after they were added to NAS100.

JOYG: I sold all my shares already and will wait for the pullback. Volume looks good but there are index funds that are required to add JOYG after they were added to NAS100.

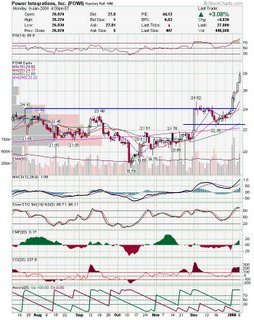

I've been targeting NWRE and will buy on the next pullback. POWI: This looks like a heck of a move and should pullback or at least consolidate into a flag.

POWI: This looks like a heck of a move and should pullback or at least consolidate into a flag. TTI: may of started slowing down. Look at volume on breakout.

TTI: may of started slowing down. Look at volume on breakout. TRAD: Added to IBD 100 after closing over 15. Strong volume with this move.

TRAD: Added to IBD 100 after closing over 15. Strong volume with this move. The following are stocks I own but may still be playable.

The following are stocks I own but may still be playable.

SUF: I would normally not recommend any stock that had moved 25%, but I think SUF is under heavy accumulation. I am holding at this point and for the foreseeable future. MTXX: I hate to buy this late in the game, but MTXX looks like a decent play here. I took a small initial position and will watch to see if I should add more.

MTXX: I hate to buy this late in the game, but MTXX looks like a decent play here. I took a small initial position and will watch to see if I should add more. MNST: I like this as an intermediate term trade. Chart looks good and I think there are a couple things favoring a move up here. Monster.com is in a hot sector and has a strong IBD rating (see below). Also, I think tech spending may be up this year, and the tech job market may be strengthening. Tech jobs are high paying, and therefore MNST would get higher commisions for these types of jobs. Chartwise, the MACD just crossed and volume is increasing on the breakout. Near term swing target is near 46, but this may become a core hold for me.

MNST: I like this as an intermediate term trade. Chart looks good and I think there are a couple things favoring a move up here. Monster.com is in a hot sector and has a strong IBD rating (see below). Also, I think tech spending may be up this year, and the tech job market may be strengthening. Tech jobs are high paying, and therefore MNST would get higher commisions for these types of jobs. Chartwise, the MACD just crossed and volume is increasing on the breakout. Near term swing target is near 46, but this may become a core hold for me.

Good Luck,

DT

Looks like I may of had blog issues last night. I have rebuilt the template and it should be OK now. CMED and REDF are rocking today. Took a position in MTXX and PRLS. Will post an update later tonight.

DT

We had a nice week last week and might be a little extended. I am leery of initiating new positions, but I think there are two sectors that bear watching. Obviously Gold and metal-ores have been rocking, but Oil Services has been very strong lately too, and may continue rallying even if indices pull back or consolidate. Watch OIH if you are playing the Oil services plays. Also, while Gold has been getting the Pub, silver and copper are experiencing their own bullish breakouts.

Here are charts of silver and copper. Both have a shot at breaking to new highs.

Here is a silver play that has been performing well. Tried to fill gap and bulls didn't let it drop. That may be a clue that this run isn't over.

Here is a silver play that has been performing well. Tried to fill gap and bulls didn't let it drop. That may be a clue that this run isn't over. This may be ready to break an ascending triangle.

This may be ready to break an ascending triangle. PCU tried to break out and pulled back. May attempt a breakout again if copper rallies.

PCU tried to break out and pulled back. May attempt a breakout again if copper rallies. This is one of the Oil service plays.

This is one of the Oil service plays. And another.

And another. MTXX may be ready to resume breakout.

MTXX may be ready to resume breakout. MNST may pull back and try and fill small gap.

MNST may pull back and try and fill small gap. BOOM broke and closed above recent resistance. They may come back and confirm support at 32's.

BOOM broke and closed above recent resistance. They may come back and confirm support at 32's. CMED had a bullish bounce off support last week, and got bordered on IBD this weekend. They may be able to break upper resistance line.

CMED had a bullish bounce off support last week, and got bordered on IBD this weekend. They may be able to break upper resistance line. I am watching PRLS for a breakout over resistance line.

I am watching PRLS for a breakout over resistance line. Good Luck and be careful of chasing stocks up. There is sure to be a reversal soon even if it only to consolidate recent gains.

Good Luck and be careful of chasing stocks up. There is sure to be a reversal soon even if it only to consolidate recent gains.

DT

I won't be posting charts tonight as I am in a poker tourney. Keep an eye on a couple of small caps tomorrow as the general market is getting a little tired. I like DIET, CKCM and HAUP here. Also, CMT has been acting funny the past few days, so it may be worth keeping an eye on. Stocks pulling back that are becoming attractive are MMUS, SUF, MCX and REDF. I am looking to the next few days of consolidation to target a few stocks. I will post the charts tomorrow or over the weekend. Also, a lot of what I posted the past few days is acting well, which has me encouraged about our outlook over the next few weeks.

Good Luck,

DT

There were a lot of bullish breakouts today and there may be some follow through tomorrow, but that is far from a sure thing. Keep the overall perspective in mind.... we are back up to resistance and there is a chance that tomorrow is a down day or late reversal day. With most stocks up, it may be wise to take advantage and sell what you are iffy about and focus on keeping your horses. I took advantage of todays rally in ford to lighten up, and I also sold lifc outright.

Yesterday I mentioned the contest I had with a few friends of mine. Below are the picks we came up with. I will update our positions from time to time. I can almost gaurantee that at least one of these will be a big winner this year, and there is a chance that you will see a few perform pretty well. I can also say that at least one of these will disappoint. All of these are based on yesterday's closing price. It's a long year, so let the race begin.

downtowntrader: cmed and redf

Nice start today as CMED had a strong day and may be breaking out of its base. Look at last nights post for charts.

btuff: ckcm and ngps

btuff is mostly fundamentals oriented and he really loves these. NGPS had a great day and CKCM has an improving chart as well.

doc: vphm and eln

two bio's is pretty risky, but this is a homerun swing if I ever saw one. both of these have the potential to double from where they are at.

lionshare: amd and jdsu

last years winner. sticking with his tech specialty. thinks it will be a big first half of the year for amd.

paige386: SVMFF and RUTH

SVMFF is a canadian silver stock that trades in the US under SVMFF or SVM.TO. Too confusing for me :). RUTH is an interesting pick that may be bottoming out.

smorg: IVN and SVMFF

More canadian mining and ores companies. We all think Gold and Silver will rock most of the year, although I think there is a pullback coming.

Although it's very early, I would like to brag that I am ahead so far.

Here are some interesting charts.

MTXX: I like this and it is breaking out of a rectangle trading range. Only problem is that this was a 10 percent move today. Woth watching though. SBUX: Starbucks may be headed towards a long term breakout. Look at previous MACD crosses and on a weekly chart you will see that if this box is broken it should be smooth sailing. Also got a little mention on IBD tonight.

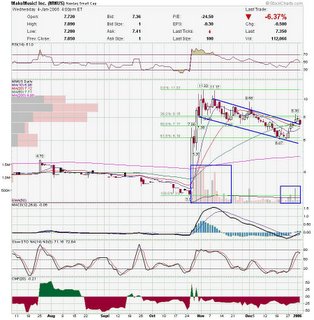

SBUX: Starbucks may be headed towards a long term breakout. Look at previous MACD crosses and on a weekly chart you will see that if this box is broken it should be smooth sailing. Also got a little mention on IBD tonight. MMUS: I posted on this a few nights ago, and we had a pullback to the trendline that should serve as support. Volume is very light on pullbacks.

MMUS: I posted on this a few nights ago, and we had a pullback to the trendline that should serve as support. Volume is very light on pullbacks. NDAQ: This should be interesting. I like NDAQ, and my gut says it will go up, but there is a lot of converging support and resistance here, so a move should be imminent.

NDAQ: This should be interesting. I like NDAQ, and my gut says it will go up, but there is a lot of converging support and resistance here, so a move should be imminent. PETS:Read notes on chart.

PETS:Read notes on chart.

Good Luck,

DT

Stock contest year 2. A few friends and I got together last year and played an impromptu game. We picked two stocks each with the idea that it would be a hold till next year. We paper traded of course, cause I would never say I won't sell, but it's an interesting game. You don't want to pick something that is overextended already, but you don't want to bottom fish either. Last year I failed miserably, picking TOPT and JNPR. We did it in December last year andI ended up down 35% average. The winner picked AMD and NVDA for near 55% average. I liked gold this year, but decided to stay away from a specific sector play. My two picks for the year are CMED and REDF. I thought about VPHM, MNST, BOOM, MRVL and a couple others. If anyone has some in mind, feel free to leave a comment.

DT

Well that certainly qualifies as a nice bounce. We are not of the woods yet, but today's action was positive with volume swelling at the right time. I will post some new charts later tonight.

DT

Santa didn't come this year (or you can say he was early) and everyone is expecting a January slide. I think it is possible we get a technical bounce at the least in the coming days. Indices (nasdaq in this case) usually don't leave gaps for too long and indicators are starting to be oversold. While this is probably not the time to be initiating any intermediate trades, I am focusing on weekly charts for most of this post. It is important to keep the longer term trend in mind when initiating a position in any stock. Also, sometime the weekly chart gives a more clear picture on some of the more volatile stocks and also shows volume increases better.

SUF: Look at the volume increase on the triangle break on the weekly chart. This may be coming into the radar screens of more institutions as the share price increases. What I like about this stock is the ascending triangle on the weekly...... and bull flag on the daily.

and bull flag on the daily. MMUS: Look at the volume here. Also, last candle is pretty bullish.

MMUS: Look at the volume here. Also, last candle is pretty bullish. SLW: This a recent IPO in a pretty hot sector. Volume is building here as well, as the name becomes more well known. This tends to be lumped in with all ores, but the are a silver stock. Weekly shows a nice uptrend....

SLW: This a recent IPO in a pretty hot sector. Volume is building here as well, as the name becomes more well known. This tends to be lumped in with all ores, but the are a silver stock. Weekly shows a nice uptrend.... and daily show consolidation over 5.50. Volume looks good here too.

and daily show consolidation over 5.50. Volume looks good here too. TALX: Made number 1 on IBD 100 which helped it break the triangle. Now it is pulling back to the breakout area and could take off from there.

TALX: Made number 1 on IBD 100 which helped it break the triangle. Now it is pulling back to the breakout area and could take off from there. LIFC: Candle pattern wise, this is an interesting setup. piercing patter on trendline confirming several previous candles on same trendline. This may head to red dotted lines which should serve as resistance.

LIFC: Candle pattern wise, this is an interesting setup. piercing patter on trendline confirming several previous candles on same trendline. This may head to red dotted lines which should serve as resistance. NWRE: Pulling back to breakout area.

NWRE: Pulling back to breakout area. CMED: May be trading in a bull flag on the weekly chart. Volume decreasing in Flag and daily chart show stock near support.

CMED: May be trading in a bull flag on the weekly chart. Volume decreasing in Flag and daily chart show stock near support. GG:I like gold stocks but not sure if this is them time to go long. I am watching GG though cause they are the closest to a base. This chart looks downright bullish and the daily doesn't look to shabby. My concern is with market being oversold and Gold maybe being a little extended. I would love a pullback in the sector.

GG:I like gold stocks but not sure if this is them time to go long. I am watching GG though cause they are the closest to a base. This chart looks downright bullish and the daily doesn't look to shabby. My concern is with market being oversold and Gold maybe being a little extended. I would love a pullback in the sector. CKCM: While the daily chart looks like a mess, I like this weekly chart. Could bounce here as daily is showing 200 sma as support.

CKCM: While the daily chart looks like a mess, I like this weekly chart. Could bounce here as daily is showing 200 sma as support.

I have several other I am looking at, but I have too many stocks to watch right now. I will be taking a closer look at the following names soon:

holx

CBG

chs

bbd

cib

ubb

cpa

mrvl

vlcm

wthn

pets

Good Luck and may 2006 bring health and prosperity.

DT